The Launch Blog: Expert Advice from the CorpNet Team

Kentucky Annual Reports: When They’re Due and How to File Them

In Kentucky, Limited Liability Companies, C Corporations, Limited Partnerships, and Business Trusts must file an annual report with the Kentucky Secretary of State office. Businesses operating as Sole Proprietors or General Partnerships do not have to file. Kentucky annual reports allow the State to provide accurate information to the public about the business entities registered there. Registered entities must file their report each year—even if they had no business activity or income. The report due date, regardless of entity type, is June 30 and businesses may file anytime between...

7 Things to Know About Florida’s Annual Report

If you have incorporated in Florida or formed an LLC in Florida, your deadline for filing your Annual Report is May 1, 2021. Here are 7 facts that you need to know to ensure that your corporation or LLC remains compliant in the state of Florida. 1. You Must File Whether Your Business Has Changed or Not While the purpose of the Annual Report is to ensure that the Florida Department of State, Division of Corporations has your company’s most updated information, you still have to file the document, even if you have no changes since last year. 2. You Can Change Several Pieces of Information...

Can a Single-Member LLC Be an S Corporation?

A single-member LLC can be taxed as an S Corporation if it meets the IRS’s eligibility criteria. In fact, both single-member and multi-member Limited Liability Companies can elect to be treated by the IRS as either an S Corporation or a C Corporation if they meet the requirements. IRS's S Corporation Qualification Criteria: Be a domestic corporation or an entity eligible to be treated as a domestic corporation. And not be an ineligible corporation (such as certain financial institutions, insurance companies, and domestic international sales corporations. Have only allowable shareholders...

Businesses Incorporated in Texas Need to Fill Out an Annual Report By May 15

Before you form an LLC or incorporate a business in Texas, it’s important to know your reporting responsibilities in the years to follow. One important ongoing compliance requirement is filing your Annual Report by May 15th each year. New business entities must file their first Annual Report by May 15th of the year following their year of formation. For example, an LLC formed in December 2024 must file its first annual report by May 15, 2025. If your Texas corporation or LLC is no longer functioning as a business, you must file a final franchise tax report within 60 days of when you end...

How to Obtain a Certificate of Existence for Your Georgia Business

If you own a Limited Liability Company, C Corporation, or other registered business entity in Georgia and you want to open a business bank account, expand your business into another state, seek funds from investors, or conduct certain other business activities, you’ll need to have a Certificate of Existence. A Certificate of Existence, known in some states as a Certificate of Good Standing or Certificate of Subsistence, is a document obtained through the Corporations Division of the Office of the Secretary of State. It verifies that your business is properly registered; up to date on...

West Virginia Annual Report: Are You in Compliance?

Most types of businesses operating in West Virginia must file an annual report with the Secretary of State Office to keep their company records updated. The deadline for submitting the report, along with the associated filing fee, is July 1 each year after the initial registration of the business entity. Business owners in West Virginia (and those wishing to expand operations from another state to WV) can benefit from talking with an attorney and accountant or tax advisor about whether they need to submit an annual report. Moreover, consulting with trusted professionals can shed light on...

Company Applicant vs. Beneficial Owner

The Corporate Transparency Act’s Beneficial Ownership Information Reporting Rule went into effect in January 2024, leaving many business owners wondering: Are they required to submit a Beneficial Ownership Information (BOI) Report? What’s the difference between beneficial owners and company applicants, and what information does a reporting company have to share about them? Although certain entities are exempt, most small Corporations, Limited Liability Companies (LLCs), Limited Partnerships (LPs), Limited Liability Partnerships (LLPs), Limited Liability Limited Partnerships (LLLPs), and...

Certificate of Subsistence: What It Is and Why You Might Need One

If you own a business that’s registered with the state in which you operate, such as a Limited Liability Company, a C Corporation, or a Limited Liability Partnership, it’s likely that at some point you’ll be asked to provide a Certificate of Subsistence. A Certificate of Subsistence, which in some states is known as a Certificate of Good Standing, a Certificate of Existence, or a Certificate of Status, is a document from the state that verifies a business is indeed operating; is properly registered; and is in compliance with federal, state, and local laws. While specific information...

How to Hire Temporary Employees

If the bed-and-breakfast you own and operate runs at full capacity for the months of July and August and the work is too much for you to do on your own, you might consider hiring temporary employees to help. The same goes for a consulting firm that just landed an important six-month assignment for its biggest client, or a building contractor who agreed to take on a large-scale renovation project. Temporary workers account for only about 2% of total nonfarm employment in the United States, according to the Bureau of Labor Statistics, but employers in many industries rely on temporary...

How to File Taxes as a Limited Liability Partnership

If your startup will have more than one business owner, you have several choices for how to legally structure your company. In today’s post, I’ll discuss the Limited Liability Partnership (LLP), which is a type of partnership that isn’t as widely known as the General Partnership or Limited Partnership business structures. The following information will help you understand what an LLP is, how an LLP is taxed, and the basic steps for creating one. Before we get into all that, I want to remind you that the type of business entity you select will affect just about every aspect of launching...

Obtain Asset Protection for Your Business

One of the main reasons to create an LLC or to incorporate revolves around asset protection. The business structure legally separates the assets of the ownership from the assets of the company. The corporation may be sued (and even go bankrupt) without loss of personal property by the ownership. As your first line of defense, I encourage you to consider the legal structure of your business. If you’re operating as a sole proprietorship (or general partnership), you’re more likely to put your personal belongings in jeopardy than if you formally register your business as a different type of...

Tax Benefits of Incorporating

Tax implications are among the most important factors to think about when deciding on a business entity type. Some business owners are attracted to the simplicity of pass-through taxation, which is how a sole proprietorship, partnership, LLC, and S Corporation are taxed. But for others, the tax benefits of incorporating as a C Corporation offer more financial advantages. A C Corporation is a business entity independent (both legally and from a tax perspective) of its owners (called “shareholders”). As such, the company is responsible for reporting its profits and losses on its own income...

Choosing a Business Structure

Choosing a business structure for your company is one of the most crucial first steps to starting a business. Your business entity type has legal, financial, and administrative implications, so it’s important you get started with the best entity for your situation.Some of the factors that will influence which business entity type you select include: Where you plan to conduct your business Wanting to have limited personal liability for your business activities Whether you will have a partner or an investor Your expected earnings and deductions Desire to minimize your self-employment tax...

Do You Need an LLC for Your Rental Properties?

Most builders and real estate investors understand the importance of protecting personal assets and optimizing their tax situation. One way to address both concerns is by choosing the right business structure for holding rental properties. Many property developers and investors choose a Limited Liability Company (LLC) for their rental properties because the LLC provides asset protection and tax flexibility. LLCs are separate legal entities from their owners (called “members”). They can have one member (single-member) or more than one member (multi-member). By setting up individual...

Can I Use a Home Address for My LLC?

Using a home address to register an LLC or incorporate a business is something many entrepreneurs think about doing. That’s understandable because many new businesses start their journey in the entrepreneur's home or garage, which allows the business to avoid office rent, unnecessary utilities, and long commutes. This not only allows more time to focus on growth, but it can also help a company turn a profit faster as it ramps up. Does this lack of address impact the business negatively? Do you need a physical address for your business? Is it legal to use your home address for business...

How to Legally Franchise a Business

If you've considered how to grow your business by leaps and bounds without starting and running dozens or hundreds of locations yourself, you may have wondered how to franchise a business. In this article, you'll learn more about what franchising means, how to determine if franchising makes sense for your business, and what's involved in franchising a business.

How Pennsylvania Is Changing Annual Reporting in 2025

Starting in 2025, Pennsylvania will retire its decennial report requirement and instead require many business entities to file annual reports. Going from reporting every ten years to every year is a result of 2022 Act 122, which Governor Tom Wolf signed into law. The new reporting rule and revised annual report dates apply to the following types of business entities in Pennsylvania: Domestic Business Corporations - June 30th Foreign Business Corporations - June 30th Domestic Nonprofit Corporations - June 30th Foreign Nonprofit Corporations - June 30th Domestic Limited Liability Companies...

Should You File a BOI Report Amid the CTA’s Questionable Constitutionality?

You’ve likely heard buzz about the U.S. District Court for the Northern District of Alabama’s March 1, 2024, ruling that the Corporate Transparency Act (CTA) is unconstitutional because it oversteps Congress’s legislative authority. As a result, plaintiffs in the National Small Business United (NSBU) et al. v. Yellen case may pass (for now) on filing Beneficial Ownership Information (BOI) reports to the Financial Crimes Enforcement Network (FinCEN). My team at CorpNet has talked with many concerned and confused business owners. They want to know if this means they don’t have to file a BOI...

What Is an Anonymous LLC?

While it may sound mysterious and intriguing, an anonymous LLC (also known as a private or confidential LLC) is like a regular Limited Liability Company, except its members are not publicly identified by the state. The names, addresses, and contact information for members remain private and do not become part of the public record or get published on the state website. Not all states grant LLC owners anonymity. But depending on the circumstances, business owners in a state that prohibits anonymous LLCs may be able to form one in a state that does allow them. Discussing your needs and...

How Often Does an LLC Pay Taxes?

If you’re considering starting a Limited Liability Company (LLC) or restructuring your business as an LLC, it’s important to know what taxes you’re responsible for, when your taxes are due, and how to file taxes for your business entity. Keep in mind that an LLC’s tax obligations can vary greatly. Multiple factors affect an LLC’s tax filing responsibilities. For example: Does the LLC have one sole owner (Single-Member LLC)) or two or more owners (Multi-Member LLC)? Has the LLC elected to have S Corporation or C Corporation tax treatment? What are the state and local income and sales tax...

Most Popular Franchise Businesses

If the thought of starting your own business seems overwhelming, there’s an option you could consider to streamline the start-up process and make it more workable. Instead of starting from scratch to build an independent business, you could consider franchising. Franchising is a business model in which an independent party buys into an established business and opens and runs their own location. It’s a popular model because it enables the established business to grow while giving an entrepreneur just starting out the advantage of being associated with a known company. The franchisor—the...

How Do You Pay Yourself as a Sole Proprietor?

Many small business owners start their companies as Sole Proprietorships. The business structure offers setup simplicity, cost-effectiveness, and minimal business compliance requirements. To determine if a Sole Proprietorship is right for them, entrepreneurs should consider the pros, cons, and nuances associated with it. In this article, I’ll discuss what a Sole Proprietorship is, how sole proprietors pay themselves, how to pay taxes in a Sole Proprietorship, and examine some potential benefits of switching to an LLC instead. What Is a Sole Proprietorship? The IRS defines a Sole...

Annual Report List by State for LLCs and Corporations

Many state governments require LLCs, Corporations, and other registered business entities to file annual reports each year. And some Secretary of State (or comparable agency) offices may require these types of reports to be filed according to different timeframes (e.g., biennial and decennial reports). This state-by-state list will help you prepare and stay in compliance.

A Guide to Filing a North Carolina Annual Report

Filing a North Carolina annual report is a yearly activity that is required to maintain your company's registration as a legal entity in the state. It contains information about the company and is due whether or not the entity is actively conducting business. The only time a company no longer has to submit an annual report is when it has been officially dissolved with the state. Who Must File an Annual Report? The following foreign and domestic companies must file an annual report to the North Carolina Secretary of State: C Corporations Limited Liability Companes (LLC) Limited Liability...

Does Your Business Have to File a Georgia Annual Report by April 1st?

Business entities that are registered with Georgia's Office of the Secretary of State must file a Georgia annual report each year. The due date for filing Georgia's annual report is April 1st. What is an Annual Report? The correct terminology for an annual report is actually "annual registration." However, many people refer to it as an "annual report" because that's what the annual filing is called in many states. Throughout this article, you'll see that I use both terms to mix things up a little for your reading pleasure! Businesses required to file a Georgia annual registration must do...

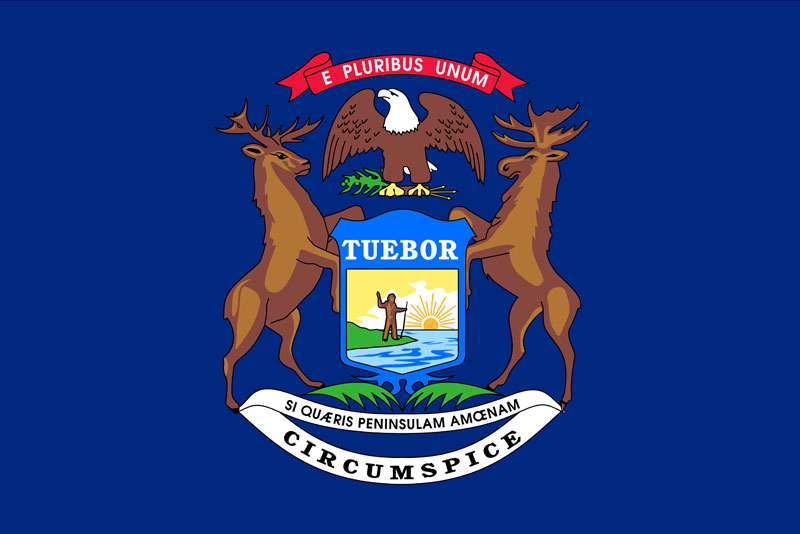

Michigan Annual Report Filing for LLCs and Corporations

The state of Michigan requires all business owners of limited liability companies (LLC) and corporations to file an annual report. An annual report is a filing that helps ensure the state's records about a business entity are accurate. Michigan has specific due dates for filing annual reports, so entrepreneurs need to stay on top of the deadlines and get their paperwork turned in on time. Submitting annual reports is one of the compliance tasks required to keep business entities in good standing with the state. In this post, we’ll cover general details about Michigan’s requirements for...

How to Perform a Business Name Search for Any State in the US

Along with deciding whether your company will operate as a Sole Proprietorship, Limited Liability Company (LLC), General Partnership, C Corporation, or S Corporation, selecting the right name for your new business is an important early step. And while choosing a name might sound like an easy, straightforward task, it’s imperative that you spend some time and effort making sure you follow the rules laid out by your state. One of the most important tasks is to make sure the name you choose isn’t already taken. Taking a name that’s already in use can result in confusion, or worse yet, legal...

Can You Turn a DBA into an LLC?

Many business owners who operate as a Sole Proprietorship or Partnership use a DBA (Doing Business As) name to market their business more effectively and present a more professional image. A DBA can serve a business well, but it’s important to realize it is just a name. A DBA is not a business entity and does not provide any liability or asset protection for entrepreneurs as a Limited Liability Company (LLC) does. What if you’ve been running your business as a Sole Proprietorship or Partnership and you’d like to switch to an LLC but continue using your DBA name? Can you turn your DBA into...

Options for Paying Small Business Taxes

While paying taxes is a certainty for small business owners, there are some options for how you might pay them. The simplest strategy for paying your small business taxes is to make sure money is available when your tax bill comes due. If that is not possible for some reason, you can register for an IRS payment plan that allows you to pay your balance over a specified amount of time, use a credit card to pay your bill, apply for a bank loan, or apply for a business line of credit. Let’s have a look at each of these options. Option 1: Plan Ahead to Pay Your Taxes The taxes you’ll pay are...

CorpNet Awarded Inc. Pacific Regionals for 2024

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. Regionals Pacific list in 2024 as one of the fastest-growing private companies in the country. This is the third year CorpNet has been honored in the regional awards. With a healthy 259% 2-year growth, CorpNet made a significant move from position 75 to 56. CorpNet's Inc. profile can be found at https://www.inc.com/profile/netcom. “I am beyond proud of the continued growth our company has achieved in the last year and our ability to secure a spot on the coveted Inc.5000 Pacific Regionals list in 2024. Our team continues...