CorpNet has always been focused on helping entrepreneurs in all industries succeed. We not only offer services to help them save time and money in forming their own businesses, but we also provide a program for accountants, attorneys, and other professionals to enable them to expand their client services and increase revenue.

I recently presented two webinars about the CorpNet Partner Program:

- Increase Revenue & Client Satisfaction Without Increasing Overhead or Staff – Which explains the Partner Program and how it enables accountants to expand their services quickly and with minimal effort.

- How to Maximize Your Revenues as a CorpNet Affiliate or Partner Offering CorpNet’s Products and Services – Which shares how participants in our Partner Program can get maximal value from it.

These webinars provide detailed information about the CorpNet Partner Program and how it can help your business. I invite you to watch and listen to them, so you get the full breadth of what they offer.

In the meantime, I’ll share some of the most important points from them so that you can better understand how the CorpNet Partner Program can be a win-win for you and your clients. Keep in mind that while the first webinar is geared toward accounting professionals, the Partner Program is also open to attorneys, business consultants, and other types of professionals and businesses for which CorpNet’s services make a good complement to their current offerings.

Top Business Benefits of the CorpNet Partner Program

How can the CorpNet Partner program help accountants overcome some of the most common business challenges?

- It enables you to differentiate your business from your competitors and gives customers more reasons to rely on your expertise.

- It helps you improve customer satisfaction – Only 67 percent of small businesses are satisfied with their accountant.

- It increases client interactions

How Does the Partner Program Expands Your Services and Revenue?

The CorpNet Partner Program allows you to be proactive rather than reactive in helping your clients by offering CorpNet’s business formation and compliance monitoring to your advisory services.

It enables you to provide additional value to your clients and add revenue to your bottom line without additional overhead or loading more work to your plate.

Why the Partner Program is a Good Fit for Your Business

Clients often look to their accountants as a key source of incorporation information. As they seek to assess which business structure and state of formation will give them the most favorable tax treatment, they naturally gravitate to their trusted tax advisor.

So, you’re already providing consultation and pointing clients to resources, but with the CorpNet Partner Program, you become a resource that can help them register their companies and keep them compliant. Best of all, while you’re helping your clients save time and money in starting and running their businesses, you open a new revenue stream for your business.

How the Partner Program Offers Value to Your Clients

With the CorpNet Partner Program, you go beyond just advising clients on the best business structure for tax purposes to also helping them file the paperwork necessary to register their business entity type and comply with ongoing filing requirements.

This helps your accounting clients:

- Gain trust and respect professionally

- Keep their business compliant

- Reduce the risks of being audited

- Position them to raise capital to fuel their growth

- Save money because they can decrease their dependence on their attorney

In running CorpNet.com, I see how much clients need an accountant’s guidance on business formation and compliance. As a document filing service, CorpNet cannot provide tax or legal advice, so we regularly refer customers to their accountants and lawyers for direction on choosing a business structure. As an accountant, you may not provide legal advice to clients. However, in many instances, it’s the tax ramifications that our customers are most concerned about, and CPAs are allowed to advise about optimal business structures and state of formation for the purpose of minimizing tax liability.

So when your clients come to you about which will be the best entity structure to maximize tax savings, doesn’t it make sense to be able to help them file the required forms, as well? You can safely help your clients do this, and earn revenue for your company in the process.

How Business Formation and Compliance Management Services Add Revenue and Profit to Your Bottom Line

Whether you’re a self-employed Quickbooks advisor, owner of a small CPA office, or a CEO of a large accounting firm, the CorpNet Partner Program gives you two options for generating additional revenue.

CorpNet Reseller Option

If you choose to resell CorpNet’s formation and compliance products, we serve as your silent fulfillment partner. We give you fixed wholesale pricing on all of our formation and compliance services, which you can mark up to your desired price points and brand as your own. Your client orders through you, and we take care of all the grunt work behind the scenes.

CorpNet has established suggested pricing for resellers of CorpNet’s white-label services:

| Limited Liability Company Set-up, DBA Registration, Licensing, Tax Permits, and Compliance | |

|---|---|

| Standard Processing (Typically 20-30 business days) | $1,000 |

| Expedited Processing (Typically 10-15 business days) | $1,200 |

| 24-Hour Rush Processing (Typically 2-3 business days) | $1,500 |

| Corporation (C-Corp/S-Corp) Set-up, DBA Registration, Licensing, Tax Permits, and Compliance | |

| Standard Processing (Typically 20-30 business days) | $1,000 |

| Expedited Processing Typically 10-15 business days) | $1,200 |

| 24-Hour Rush Processing (Typically 2-3 business days) | $1,500 |

| Fictitious Business Name Registrations with Notice of Publication (aka DBAs or FBNs) | |

| Standard Processing (Typically 20-30 Business days) | $500* |

All pricing excludes state government fees.

*Includes notice of publication.

What revenue and profit might you expect monthly? It will depend on what you charge your clients and how many formation and compliance services you sell each month.

For example, someone who is not a CPA and runs a one-person bookkeeping or business consulting business might sell one LLC package per month (standard processing) and charge $750 (not including state and government fees). After CorpNet’s wholesale fee of $250, that professional will have made a profit of $250.

In the case of a certified CPA or Quickbooks ProAdvisor with a small office, that business might sell, on average, four LLC packages per month (standard processing) at $1,000 (plus state and government fees) each. Revenue per month would be $4,000, and profit would be $3,000 (income minus CorpNet’s wholesale fees, totaling $1,000).

A larger accounting firm will likely sell a higher volume of LLC packages (standard processing). Say it would sell 20 LLC packages at $1,000 each (plus state and government fees). Its revenue would be $20,000 for the month, and its profit would be $15,000 (after CorpNet’s wholesale fees, totaling $5,000)

As you can see, there are many opportunities to earn significant income for your business with minimal time and effort on your part!

CorpNet Referral Partner

If you choose to refer your clients to CorpNet and have us directly interface with them, you can earn a commission from us (up to 25 percent) for every successful sale of a formation or compliance service.

CorpNet White Label Services and Products

- Incorporation and LLC Filings (LLC, Corporation, S Corporation, Professional Corporation)

- Business Licenses and Permits

- Registered Agent Services

- Annual Reports and Filings

We enable you to help your clients register and maintain their businesses in any or all of the 50 states in the USA.

How CorpNet Makes It Simple For You

Of course, we are here to help you gain a more thorough understanding of the filing requirements related to the various business entity types available to your clients.

We provide you with:

- A dedicated account manager, providing personalized support when onboarding and on an ongoing basis.

- Expert attention to your clients’ formation and compliance needs.

- Proactive alerts to clients’ upcoming filing requirements and due dates via our online Compliance Portal.

- Easy access to view and print official documents.

- Flexibility – If you’re interested in having a custom program designed exclusively for your company, we’ll be happy to collaborate on it.

Ways to Maximize Your Revenue from the CorpNet Partner Program

Often clients don’t realize everything that’s involved with formation and compliance.

Below, I’ve listed the many services (in all 50 states) that can generate revenue for your business when you partner with CorpNet:

- Business name searches

- Business name registrations

- Business name reservations

- Fictitious business name filings (DBAs)

- Business license searches and applications

- Reseller permit applications

- Federal Tax ID Number applications

- State revenue registrations

- Articles of amendment

- Reinstatements

- Initial report filings

- Meeting minutes

- Bylaws

- Annual meetings

- Annual statements

- Annual report filings

- Mergers

- Articles of dissolution

- Certificates of good standing

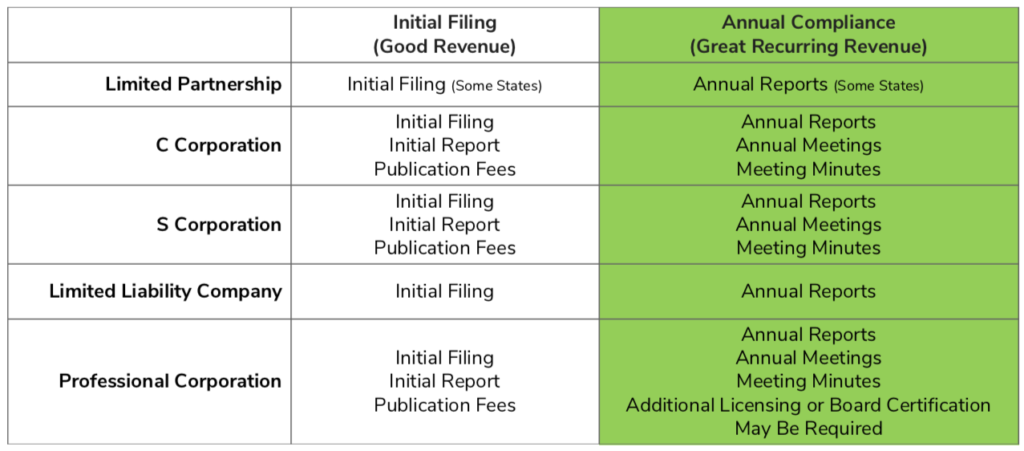

While some of these provide one-time revenue, others provide annual recurring revenue. As you can see from the chart below, different business entity types have different one-time filings and yearly filings required of them.

Tips to Maximize Recurring Revenue from Ongoing Compliance Services

Here are some suggestions to help you raise awareness of your expanded offerings and gain customer confidence in them:

- Focus on your specific audience and think through the compliance requirements they are currently missing – Think about whom you serve, the compliance requirements they need to manage, and what they might not be aware of.

- Provide high-quality content to educate your audience about ongoing compliance requirements – Use tools to help brainstorm content ideas, leverage CorpNet’s free tools and resources, set up an editorial calendar, so you publish compliance information when it’s most relevant.

- Show your clients how simple it is to say compliant by using CorpNet’s Compliance Portal.

CorpNet Educational Materials and Self-Service Tools

We’re here to help you every step of the way! CorpNet has a number of free resources and tools available to help you and your clients:

- Starting a Business Checklist

- Business Structure Wizard

- Business Name Search

- Incorporation Guide

- LLC Guide

- Filing a DBA Guide

- CorpNet’s free Compliance Portal

- Templates for meeting minutes and more – These are all available for you to share with your clients for free. We can even customize templates (for a small fee) for specific states if needed.

Marketing Your Formation and Compliance Management Services

As with any new service offering, effective marketing of your formation and compliance services will fuel your success.

Promotional Materials and Support

CorpNet makes it easy to promote the services you’re offering as a CorpNet reseller or referral partner. We offer tools to streamline your marketing efforts, including affiliate banners that have proven success in making sales conversions.

Blogging

One of the most effective ways that we’ve found to market our formation and compliance services is through blogging. Although you might be uncertain about determining blog topics that will engage your audience, I assure you there are ways to make it a painless process.

My second webinar shares about some tools that will help you in your topic brainstorming efforts:

I also encourage you to consider using tools like MeetEdgar and dlvr.it that will help you automatically share and reshare your content to your social media profiles. They make it easier to consistently stay top of mind with your audience and drive traffic to your website.

Client Intake Questionnaires

To make it easier for our partners to gather the information they need from clients when selling them LLC and Corporation formation packages, we’ve created client intake questionnaires. These questionnaires eliminate guesswork and facilitate a smooth order process.

LLC Client Intake Questionnaire

- What state will the LLC be formed within?

- Is this a new business registration?

- What is the business name for the LLC?

- What will be the business activity of the LLC?

- What is the business address for the LLC?

- Who will be the registered agent for the LLC and what are their name and physical address (No PO Box or PMBs allowed)?

- How many members will the LLC have and their legal names?

- Will there be any employees? If so how many? What are the estimated hire date and the total estimated salary paid within 12 months of formation?

- What is the fiscal year date for the business? Default is 12/31 unless specified otherwise

- Will the LLC be filing a DBA tradename for this entity?

Corporation Client Intake Questionnaire

- What state will the Corporation be formed within?

- Is this a new business registration?

- What is the business name for the Corporation?

- What will be the business activity of the Corporation?

- What is the business address for the Corporation?

- Who will be the registered agent for the Corporation and what is their name and physical address (No PO Box or PMBs allowed)?

- How many shareholders will the Corporation have and their legal names

- Will there be any employees? If so how many? What are the estimated hire date and the total estimated salary paid within 12 months of formation?

- What is the fiscal year date for the business? Default is 12/31 unless specified otherwise.

- Will the Corporation be filing a DBA tradename for this entity?

- How many shares will the Corporation be authorized to issue for this

Corporation (Default is 1,500)? - What will be the par valuation per share (Default is $0.01 par value)?

- Will there be an S Corporation tax designation made for this Corporation?

Ready to Partner with CorpNet and Grow Your Business?

Now that you’re aware of how the CorpNet Partner Program can benefit your business and your clients, I hope you’ll watch the first and second webinar to learn more and contact us with any questions.

Whether your interest lies in being a reseller or a referral partner, we’re here to help you enhance your value to your clients and increase your profitability.