Apostille vs. Authentication

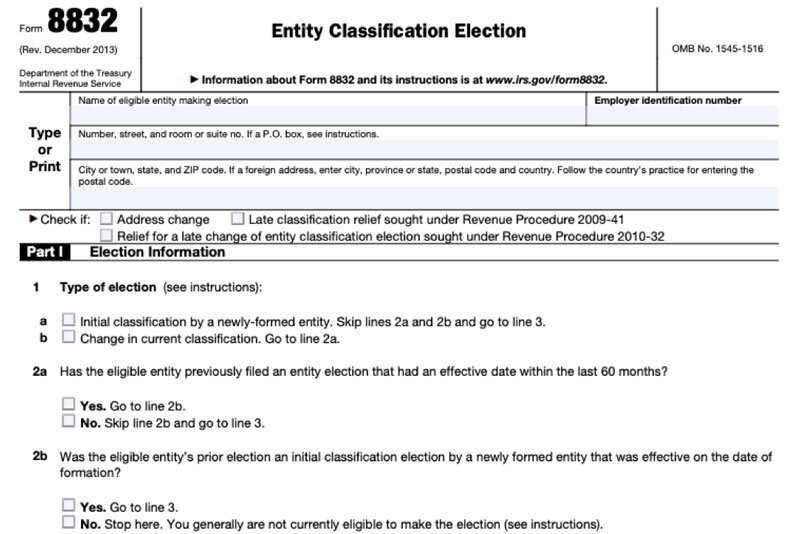

Apostille and authentication certificates serve the similar purpose of authenticating official government-issued documents (such as a business’s Articles of Incorporation or Articles of Organization). They certify the origin of documents and the authenticity of the...