What is a Business Statement of Purpose for an LLC or Corporation?

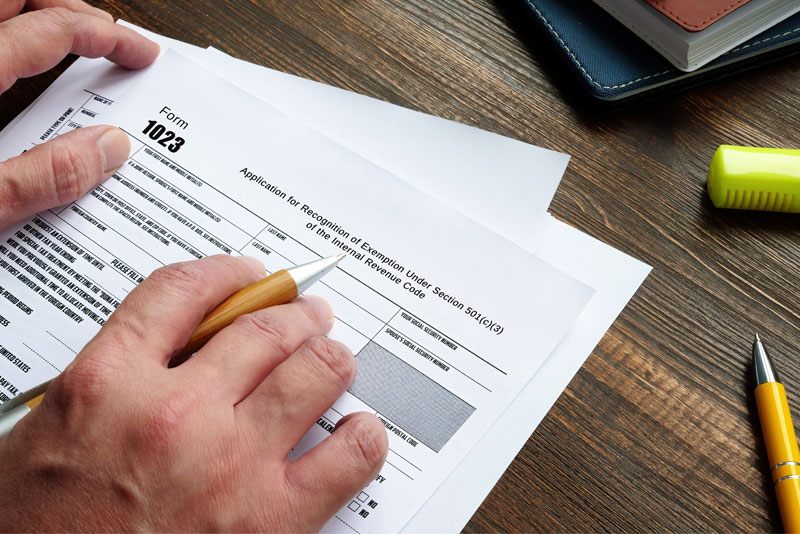

When starting a Limited Liability Company or C Corporation, businesses in most states must provide a written statement of business purpose in their formation documents (Articles of Incorporation or Articles of Organization). The business purpose statement describes...