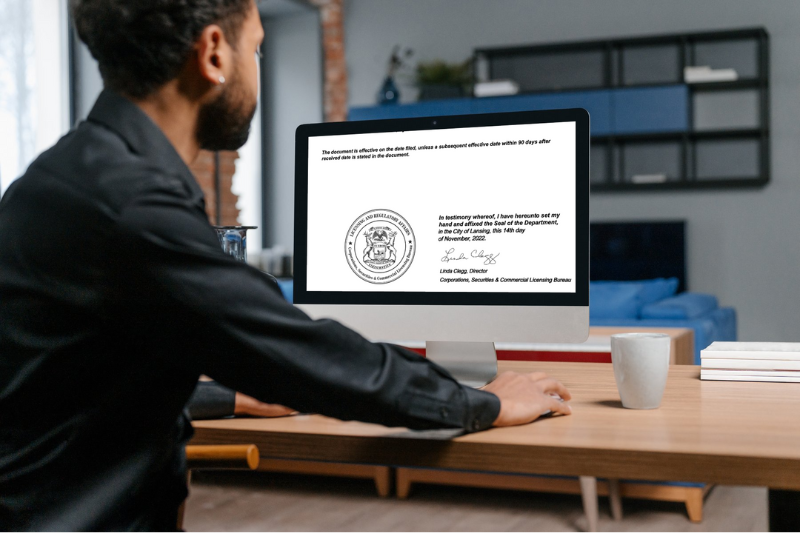

Annual Report Requirements

Are you confused about your business' annual report requirements and if you need to complete one? You're not alone. Requirements for annual reports vary by state, so they can be a little intimidating for the average business owner. If your business is a Limited...