BOI Reporting Requirements By Business Entity Type

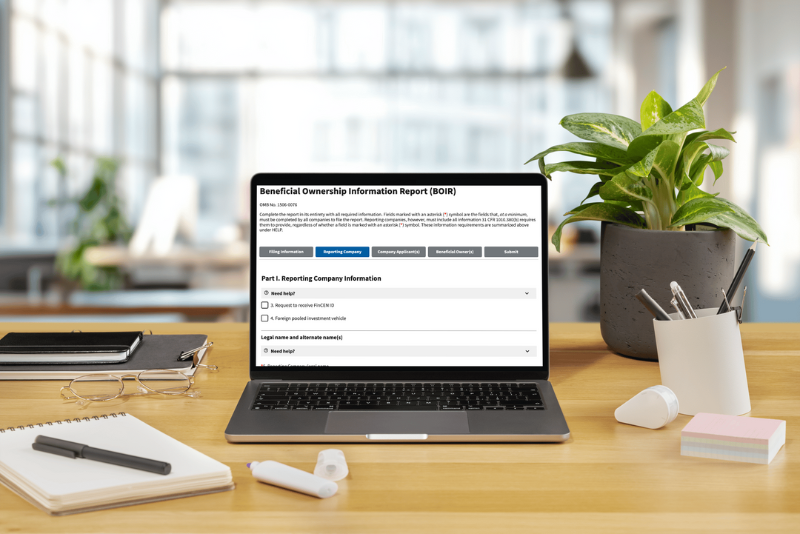

As the deadline approaches for reporting companies to submit their BOI report to FinCEN, many business owners are still questioning if they need to file a report. I field that sort of inquiry a lot when presenting webinars on the topic and the answer is often...