The Launch Blog: Expert Advice from the CorpNet Team

How Smart Businesses are Pivoting to Find Success in the Midst of COVID-19

Business owners are constantly moving. Whether it’s tracking new trends, operating the shop, meeting with clients, or attending networking events, you’d think there can’t be one more thing to add to their plates. And then, COVID-19 hit. As business owners ourselves, we saw a new kind of busy that was one of pivoting to meet new demands in a time of crisis. Pivoting business focus is not something unique to the time of coronavirus. Being able to quickly change or redirect a business is one of the hallmarks of entrepreneurship. Fortunately, smart business owners are excellent “pivoteurs,”...

Post-COVID Marketing Strategies for Accountants

Clients need their accountants more than ever in our post-COVID-19 world. Whether it’s getting ready for the extended tax deadline, figuring out how to utilize government relief funds or how to start a new business in a recession, accountants need to make sure their services are in the foreground of their customers’ needs. Here are five post-COVID marketing strategies for accountants to win and keep clients for the long-term. Establish the Business as Post COVID-19 Experts As the economy struggles to get back on track and clients have specific questions on how to file taxes, apply for...

Are Your Accounting Clients Worried About a Recession? Why They Need You Now More Than Ever

As far back as October 2019, half of Americans were already concerned a major recession was on the horizon and now that concern has become a reality, according to top economists. According to the National Bureau of Economic Research, the U.S. economy actually stopped growing in February this year, following an economic expansion that lasted more than 10 years. And, it all happened fairly quickly as the COVID-19 pandemic effectively shut down the economy and compounded unemployment. So, it’s not at all surprising your accounting clients are worried about the recession. It’s up to you then...

LLC-5 and the California Foreign Limited Liability Company

What is an LLC-5? The LLC-5 is a California State form used when a domestic limited liability company formed in another state (or country) wishes to become a foreign limited liability company in California. The official name of Form LLC-5 is “Application to Register a Foreign Limited Liability Company.” Approval to operate as a foreign LLC is known as "foreign qualification." As a business owner, learning more about the LLC-5 and the process of becoming a foreign LLC in California will serve you well if you're thinking about expanding your company. If you have registered a limited...

Remaining Independent Under California’s New AB5 Law

Whether you work as an independent contractor or your business hires independent contractors, California’s new AB5 law, which went into effect January 1, 2020, forces your hand on becoming an employer or an employee depending on how you conduct your business. The Existing Employee vs. Contractor Designation Up to now, you’ve probably made sure you’re adhering to the IRS classification rules for independent contractors, which are as follows: Behavioral Control: A worker is an employee when the business has the right to direct and control the work performed by the worker, such as when and...

What Entrepreneurs Should Know About Calculating Sales Tax for Business

Confused about how to calculate sales tax for business? Learn about recent sales tax legislation, tools for calculating sales tax, and more.

Accounting Franchises: Are They Really Worth the Money?

Traditionally, when you think about starting an accounting business, you envision building the business from scratch and all that entails—doing market research, financing your startup, differentiating your business in the marketplace, etc. But there’s another option you may not have considered: buying a proven concept of accounting franchises. There are a number of accounting franchises available, some of which you may have heard of and some you likely haven’t. The decision to start an accounting business on your own or with the support of a franchise system depends on what kind of...

Don’t Let Poor Accounting Firm Management Stifle Your Growth

What barriers to business growth is your accounting firm facing? Although the answers to that question might vary from industry to industry, I’m sure most boil down to similar sentiments. I know in my business, bandwidth can be a barrier to growth—but not bandwidth in the technical sense. Instead, we’re sometimes limited by our own bandwidth and how much our team can accomplish with the time and resources we have. Sometimes we manage our bandwidth well, and sometimes we don’t. There were times we tried to take on a task we should have outsourced, or skimped when a tech upgrade would have...

Five Side Hustle Options for Single Moms

Throughout my career, I’ve managed all kinds of people with all kinds of living situations. Out of all my employees, I’d have to say single moms are among the hardest working and most dedicated — no matter what life challenges are thrown at them. Making enough money to support yourself and your children as a single mom while still handling all of the childcare duties yourself is one of life’s biggest challenges. For some single moms, the traditional 9-to-5 job may not fit their schedule (nor sufficiently pay their bills). One way around this: Start a side hustle that allows you to earn...

How to Become a Virtual Bookkeeper

Coming from the corporate world, leasing office space seemed like the obvious choice when I started my own company. But after 18 months of commuting to an office and paying rent and other overhead expenses, my two partners and I realized the cost—and time—savings of transforming into a virtual business. Luckily, we all had space to work from our homes, and with the right equipment, we made the transition to being a virtual business without a hitch. If you’re just starting out or, like us, tired of paying for office space, there is another option: Become a virtual bookkeeper. With the...

Do I Need a Business License to Sell on Amazon?

Entrepreneurs who want to sell their products through Amazon’s marketplace face many of the same opportunities and challenges as brick-and-mortar stores. Naturally, they have a lot of questions about launching and running an online business. It’s exciting to think of the possibilities but often daunting to figure out where to start, what to do, and where to turn for help and direction. One of the things these business owners want to know is, “Do I need a business license to sell on Amazon?” Regardless of whether an Amazon seller has formed an LLC or corporation or is operating as a sole...

What to Expect When Selling Your Business

Maybe your end game has always been focused on selling your business. Or is the pace of running a business becoming too much, and you’re ready to slow down and retire? Perhaps you have a new business idea and you want to sell your business to pursue (and finance) that dream. Whatever your reason for selling your business, your timing is spot-on. According to BizBuySell, an online marketplace for small business buyers and sellers, small businesses are currently selling for record-breaking prices. BizBuySell surveyed 2,300 small business sellers and future business buyers and found sellers...

Do I Need a Startup Advisor?

A startup advisor can be invaluable to help you navigate through startup pitfalls, structure your company, find funding or scale up your business for profitable growth. I recommend a startup advisor -- provided you can devote the time to make the most out of your advisor’s expertise, talents, and connections. If you just go through the motions without leveraging what your startup advisor has to offer, then it will be a waste of time. But if you are committed to accepting advice and mentoring, and you pick the right startup advisor, you can accelerate your business’s success. So exactly...

Closing a Business Checklist: Ten Steps From Our Experts

All businesses go through ups and downs, and many will suffer cash flow crises. After some tough times, you may be tempted to walk away from your business - but closing down a business is not a decision that you should make in a fit of frustration. Starting a business is so exciting, but the day-to-day grind of running a small business can wear down even the most intrepid entrepreneur. That said, if you decide this path is the right decision, here is a comprehensive closing a business checklist that will highlight some of the big issues that you will need to work through. Ten Steps to...

Small Business Tax Advice and Survival Guide

Tax season comes to all businesses big and small, and can be a headache no matter how well you think you’ve prepared. For a small business owner wearing many (or all) hats in the business, it’s an unwelcome extra task sure to cause late hours and frayed nerves. To handle the additional workload during tax season, CorpNet offers some small business tax advice and presents our Tax Season Survival Kit for business owners. Step 1. Gather All Necessary Documentation The first step in preparing for taxes is gathering any necessary documentation. Ask your tax accountant for the list of figures...

Symptoms and Remedies for 13 Common Entrepreneurial Pitfalls

It seems that everyone on Instagram is an Entrepreneur or CEO. What used to be a high risk and scary choice, has now been glamorized into fast money, luxurious lifestyles, and ready-set-go businesses. A picture is worth a thousand words, but the stories behind the glossy pictures are anything but fancy. I know the true stories of self-doubt, self-sabotage, and business burnout. Over the years I've seen the same 13 challenges and entrepreneurial pitfalls in myself, my clients, and other entrepreneurs: Not Having a Clear Focus/Mission Trying to Be All Things to All People Lack of Revenue...

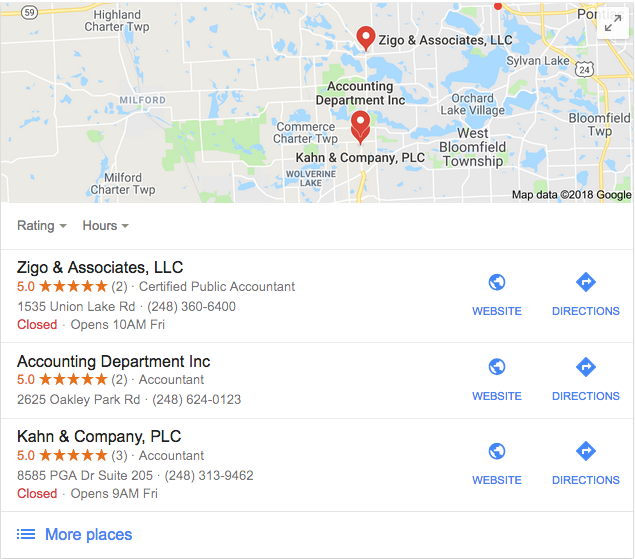

Accounting SEO: Local Search Optimization You Need to Know

Just like traditional businesses, accountants and CPAs have many options available for promoting and growing their service revenue. One of the most vital options is search engine optimization or SEO for short. I might be just a little bit biased since I've been working with SEO for fifteen years. But I am with good reason. I have experienced the benefits of SEO first hand and I know SEO can be a game-changer for an accounting practice or single accountant office. An accounting SEO strategy is similar to that of regular SEO, although there is one important nuance to remember. Since most...

Five Ways to Optimize Your Accounting Firm Operations

If you’re like most entrepreneurs, you frequently get the urge to change the way you do things and replace them with new systems and fresh ideas. After all, spring is the time for new beginnings, and your accounting firm operations could probably use a bit of a refresh. As you well know, your operations are the crucial activities of your business, from sales and accounting to marketing and customer service. It’s important for all parts of your operations to balance and support each other. Keep reading to learn how to optimize your accounting firm operations and boost your bottom line. 1....

7 Expenses You Can Save On by Working from Home

In the past, it seemed pivotal that an entrepreneur have a brick and mortar or office location for their business. If they were unable to afford or secure one, many people would abandon their business dreams altogether. Luckily, this has changed, as more and more entrepreneurs are opening or moving their businesses to their home. In fact, there are as many as 38 million home businesses across the U.S.! Although there are many perks of running a home business, such as having a flexible schedule and improved work/life balance, one of the most notable is that you can save money. With a...

CPA Burnout is Real: Take These 5 Steps to Push Through

Are you distancing yourself from relationships, feeling a loss of personal accomplishment or just overall suffering from emotional exhaustion? You could be on the dangerous road to CPA burnout. Whether your accounting firm is just starting out or growing by leaps and bounds, running your own business can be extremely stressful. You may never have imagined that your entrepreneurial dream could turn into an entrepreneurial nightmare, but CPA burnout is real. Running your own CPA business means being all things to all aspects of your business. Not only are you the boss (the buck does stop...

Dissolve an LLC With These Six Easy Steps

For a variety of reasons, entrepreneurs may decide to close the business they worked so hard to start and grow. Situations change and the need to dissolve an LLC or corporation may need to be addressed. An entrepreneur can grow tired of small business ownership or may simply want to retire. Possibly the business has been losing money or it isn't as profitable as it needs to be. Regardless of the reasons, an LLC needs to be dissolved in a formal and methodical manner. This task doesn't have to feel daunting. Our six easy steps will provide a guide for closing a business within the...

Why a Business Mentor Can Impact Your Business

As a business owner, you want to use every advantage to help ensure success. One opportunity to consider is a business mentor. A business mentor is an entrepreneur with more experience than you and who’s there to help you achieve your goals. It’s someone with no stake in your company that you can trust to keep you moving ahead. Unlike business coaching, which usually is a limited engagement focused on specific business problems, with mentoring you can develop a relationship that lasts indefinitely and is personally and professionally rewarding to both parties. Why You Should Seek Out a...

Recognizing and Managing Entrepreneurial Burnout

Every single business owner goes through periods where they've lost their oomph. Sometimes, it's due to a struggling business. Perhaps that growth curve has stagnated (or flatlined) or the feedback you're getting is that your product is all wrong. Perhaps your team is in conflict. Perhaps your expansion has failed, and you're having to go through layoffs or cutbacks or stop the growth of a new division. Oomph goes away for other reasons. One friend of mine found herself without the oomph to keep going because her business had succeeded. She had spent years pursuing financial freedom, and...

Ten Startup Podcasts for Today’s Modern Entrepreneur

It’s no surprise why today’s modern entrepreneurs like to listen to startup podcasts. Podcasts are portable -- a great way to get information when you can’t read but can listen. Often podcasts contain golden tidbits that you might not pick up in a written piece. Many startup podcasts include interviews with experienced business experts who can offer invaluable insights to help you grow your business in ways you never considered before. And best of all, they are usually free. Here are 10 startup podcasts to put on your listening list, along with a description of why each is a terrific...

Creating Your Own Business and Loving What You Do!

The entrepreneurs you read about or see on TV may seem like overnight successes—but in reality, creating your own business doesn’t happen overnight. Behind every successful business idea, months (or even years) of thought and planning have gone into launching it. After all, who wants to risk the money, time and effort required to start a new business on a mere whim? One of the keys to success is creating a business you’re excited about. Your passion will help you persist through all the obstacles. Here are three ideas for creating your own business and loving what you do. Creating Your...

Finance Your Business With These Low Stress Options

Today’s business owners have more options for business financing than ever before. But some methods to finance your business may cause you to toss and turn at night more than others. Of course, stress can be subjective. One person’s definition of stress may be different from another’s. But this list can help you sort through the different ways to finance your business that are less likely to cause you stress or at least allow you to choose what you consider to be low stress. Here are some lower-stress financing options for your small business. Low-Stress Ways to Finance Your Business...

Five Tips for Hiring Freelancers

As your business grows, so too does your payroll. Hiring can be one of the biggest struggles for growing business. The amount of time, money, and other resources needed to find, vet, hire, and train new employees are overwhelming. And, when these new employees don’t work out, you find yourself in an even bigger hole than before. Therefore, many successful businesses are turning to short-term contractors, or freelancers, to alleviate some of the bandwidth struggles they are experiencing. Using a freelancer can make sense if you want to mitigate the risks of new hires. Freelancers are...

Four Ways Busy Entrepreneurs Can Show Their Loved Ones They Care

Although Valentine's Day has passed, it doesn’t mean the time has expired for us busy business owners to show our family and friends we love them. Building and nurturing relationships never goes out of season. And now more than ever, with the divide among people getting wider as the political and social climate becomes ever more heated, I believe we all need to step up our efforts to show we care. But when you’re an entrepreneur bogged down with countless tasks and multiple concerns on your mind, how can you mange all that AND show your people some love? That’s challenging for all...

Should Your Company Use a Professional Employer Organization?

Small business owners may be new to the phrase professional employer organization, but PEOs have been around now for several years and changing the face of human resources management. According to the National Association of Professional Employer Organizations (NAPEO), small businesses that work with a PEO grow 70 to 9 percent faster, experience 10 to 14 percent less employee turnover, and are 50 percent less likely to go out of business. Although these sound like terrific benefits for any small business owner, there are also some drawbacks to working with a professional employer...

Six Tips To Help Business Leaders Gracefully Handle Adversity In The Office

In an ideal business world, everyone working at a company would always get along famously and harmoniously collaborate day in and day out toward shared objectives they all believe in passionately. Sounds nice, right? Unfortunately, it’s not very realistic—neither for the entrepreneur starting a business nor the business owner running an existing business for years. In all companies, leaders face adversity within their ranks at times. Adversity isn’t usually fun, but it doesn’t have to be debilitating either. How can you manage adversity gracefully so it doesn’t hurt your business? Below...