The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

How to Start an Amazon Business

If you've been intrigued by the flexibility and income potential of selling online, starting an Amazon business is probably at the top of your to-do list. There's no denying Amazon's reach and reputation, which is why so many Americans have a strong pull toward launching an Amazon store. If you're on the fence about jumping into the world of Amazon, these statistics will solidify your plan: Amazon receives over 2 billion visits per month Amazon sellers can reach customers in over 180 countries There are over 300 million active Amazon shoppers worldwide Customers complete 28% of their...

How to Legally Start a Nonprofit Business

There is nothing more fulfilling than directing time and energy toward helping others in need. If you're passionate about a cause, you may have wondered how to start a nonprofit business. Some aspects of starting a nonprofit organization are similar to starting a for-profit business, but nuances exist. Incorporating a nonprofit can be confusing and complicated. Let’s dive into what it means to be a nonprofit organization and explore some of the considerations and steps involved in becoming one. Please keep in mind that the information that I'm about to provide in this article is not...

What is a Holding Company?

Many business owners operate multiple businesses and there’s a good reason for that. Once you have one business and business structure in place, it’s much easier to get a new business off the ground than if you had to start from scratch each time. At some point in your entrepreneurial life, you may come upon an idea or opportunity too good to pass up. But you have no intention to stop operating your current business. So, the question becomes how should you structure the new business. Should it be a part of the original business, a DBA (Doing Business As), or a completely separate business...

Do You Need an LLC or S Corporation When Purchasing Rental Property?

So, you want to be a landlord? Here’s what to know about setting up a rental property business and protecting it with a Limited Liability Company (LLC) or S Corporation. Whether you want to purchase property to rent out on Airbnb or you want to lease office space, it’s important to understand that how you structure the property purchase affects your liability and your taxes. To be clear, we are not talking about merely renting out your home or a room in your house for a short timeframe. According to the IRS, rental income from a short-term period is tax-free as long as the room or house...

When Personal Liability Protection Doesn’t Work for Corporations and LLCs

Did you structure your business as a C Corporation or LLC for limited liability protections? For most scenarios the extra filing requirements, paperwork, and fees are worth it—your personal liability protection helps make sure your assets are protected from the business’s debts and legal issues. And that goes for the corporation’s shareholders and LLC members, too. Creditors can’t come after members’ cars, houses, or personal possessions to pay for attorney fees and unpaid invoices. But it’s called limited liability, which means there are some notable exceptions. Here’s what to know and...

How to Start a Business in West Virginia

A lot of entrepreneurs have decided to start a business in West Virginia and there is good reason. It is centrally located and within an eight-hour drive from major metropolitan areas and it offers some of the country's lowest labor and utility costs. Known as the “Mountain State,” West Virginia’s dependence on its mineral resources has declined in recent years, and it now boasts numerous industries, including aerospace, manufacturing, information technology, and energy production. Plus, its central location makes fulfillment distribution a thriving industry in the state. If you’ve been...

How to Find Small Business Grants

Small business owners often ask if they can obtain a grant for their business. The great news is you can. Small business grants range from a few hundred to thousands of dollars. Each grant has its own guidelines, requirements, and purposes. Getting a grant doesn’t happen overnight. The grant application process can take several months, and you will encounter many other companies competing for the money. Nonetheless, getting a grant award can be just the boost your business needs. One of the best aspects of getting a grant, as opposed to a business loan, is that grant money does not need...

Answering Your Questions About LLCs

If you’re considering forming an LLC, you’ve probably got questions. Fortunately, we’ve got answers. We’ve helped thousands of people form an LLC, so you could say we’re kind of experts on the subject. Here are some of the questions we get the most. What Exactly is an LLC? An LLC — or Limited Liability Company — is a legal entity that shares similarities with both corporations and partnerships in that it combines the limited liability features of a corporation with the flexibility and tax benefits of a partnership. What are the Benefits of Forming an LLC? Protection of Personal Assets...

Your Complete Guide to Starting a Business in New Mexico

With the 5th lowest labor costs in the country, according to the newest WalletHub study, the “Land of Enchantment” state boasts a thriving small business community. According to the Small Business Administration (SBA), 99% of all businesses in New Mexico are small businesses. If you’ve been thinking about starting a business in New Mexico, here is a comprehensive look at the many things business owners should know and address to get their businesses up and running. 1. Nail Down Your Business Idea Before spending time and money starting a business, entrepreneurs should do their due...

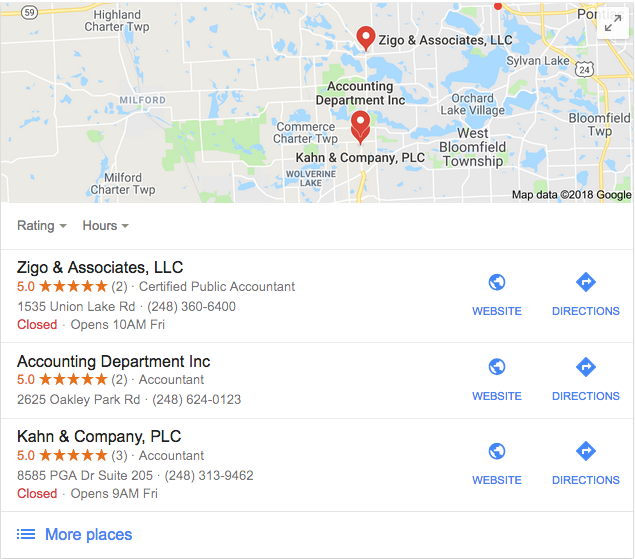

Accounting SEO: Local Search Optimization You Need to Know

Just like traditional businesses, accountants and CPAs have many options available for promoting and growing their service revenue. One of the most vital options is search engine optimization or SEO for short. I might be just a little bit biased since I've been working with SEO for fifteen years. But I am with good reason. I have experienced the benefits of SEO first hand and I know SEO can be a game-changer for an accounting practice or single accountant office. An accounting SEO strategy is similar to that of regular SEO, although there is one important nuance to remember. Since most...

The State of Small Business Revenue

As a small company, CorpNet understand the challenges small businesses face, especially in an uncertain economy. However, entrepreneurs are resilient and remain the country’s economic backbone. Small businesses account for 99.9% of all businesses in the United States and employ 61.7 million Americans, which accounts for 46.4% of private-sector employees. Over the years, we’ve helped thousands of small business owners start and grow their companies. New business owners have lots of questions, business terminology can be confusing, and they frequently wonder about the true revenue potential...

What Is Form 1065?

Partnerships (and LLCs taxed as Partnerships) must get acquainted with this IRS Form 1065 for U.S. Return of Partnership Income. Form 1065 is an information return that Partnerships use to report their income, gains, losses, deductions, and credits. While Partnerships are pass-through entities and business profits and losses flow through to the partners’ personal tax returns, Partnerships are still responsible for filing Form 1065 to report their financial information to the IRS. Moreover, a Partnership must use the form to prepare Schedule K-1 forms for its partners to identify the...

What Is an Assumed Business Name?

A company might request to use an assumed business name instead of its legal name for conducting business. This is more commonly known as a DBA (Doing Business As). In this article, I’ll explain why business owners might want to use an assumed business name, how to get one, and other important details for anyone considering using an alternate name for their company. Legal Name vs. Assumed Business Name Legal names: A Limited Liability Company’s (LLC) or C Corporation’s legal name is the one that is registered with the state on the entity’s formation documents. A Sole Proprietorship’s or...

Happy Mother’s Day

As a mother of four, I am very well aware of the challenges and pressures of raising kids today, especially while also running a business. I’ve learned a lot over the years—my first two kids were twins—so I had no choice but to learn quickly. In honor of Mother’s Day, I wanted to share some of what I’ve discovered over the past 21 years of being a mom. Be the best version of yourself in front of your children. No matter how you’re feeling at the moment, it's critical that you model healthy behavior. This means showing your kids the importance of being honest and trustworthy, keeping your...

How to Change an LLC’s Ownership Percentage

One of the reasons why entrepreneurs find the Limited Liability Company business structure attractive is that it gives them flexibility in dividing ownership among the LLC’s members. How you determine LLC ownership percentages can be based not only on members’ financial stakes in the company but also on the expertise they bring and the time and effort they spend managing and working in the business. While LLC members can have different ownership percentages, the ownership interests of all members in total must add up to 100%. For example, a multi-member LLC with three members might...

A New Approach to Setting Business Goals

Success means different things to different people. Regardless of how you define it, success depends on your goals and what you want from your business in the months and years ahead. Often, entrepreneurs think of their business goals as achieving specific metrics or dollar amounts. Paying attention to numbers is important, but I believe there’s much more to consider when pondering what success looks like and how to achieve it. As a serial entrepreneur, I can attest to this: your business affects virtually every aspect of your personal life. From your health and interpersonal relationships...

Can You Transfer LLC Ownership?

In the world of entrepreneurship, change comes in many forms and it is inevitable. People who were once robustly passionate about their business endeavors may find new opportunities or face life situations that lead them to focus on other priorities. What can you do if that happens to members of a Limited Liability Company (LLC)? LLC members might decide to transfer the ownership interests in their company for a variety of reasons. Ownership transfer can occur when new LLC members are added, one or more existing LLC members want to sell their shares of ownership, or an LLC member dies or...

What is a Certificate of Registration?

If you’re an accountant, attorney, or in the business of otherwise professionally advising entrepreneurs, you may have had clients inquire about what they need to do to expand their companies into other states. One of the most important steps involved in the process is to file a Certificate of Registration in the additional states where LLC or corporation wishes to conduct business. You may have heard it called by other names, such as foreign qualifying or filing a Certificate of Authority. Filing a Certificate of Registration means that the LLC or corporation wants to operate as a...

How to Legally Start an eCommerce Business

If you have been considering starting an eCommerce business, you’re exploring an industry with a promising outlook. The last few years have forced many people to buy products online and this new way of shopping isn't going away anytime soon. In today's article, we'll review the primary eCommerce considerations you'll need to think about and then we'll walk through the general legal steps for how to start an eCommerce business. Top Questions for Starting an Online Business As you work through the issues that I've shared below, I encourage you to research the industry you're interested in...

The Right Way to Terminate a Partnership Agreement

There are many reasons why you'd want to terminate a partnership agreement. The goals of one or both partners have changed, your working styles are incompatible, or there are fundamental disagreements about business operations and decisions. Whatever the reason, the partners must understand and follow the correct procedures and regulations for partnership termination, so all parties are legally separated from liability. What is a Partnership? A partnership is a legal entity where two (or more) people own and operate a business, and each partner owns a percentage of the assets and...

LLC’s: Best Biz Structure to House Multiple Properties

With any property, there are inherent liabilities — from a broken balcony railing to old electrical wiring or mold. The LLC forms a wall that shields individual owners from personal liability. If sued by a tenant or guest, the defendant is the LLC, not you. And the judgment can be collected only from the LLC's assets, and not from your own personal assets.

California LLC Franchise Tax Waived in First Year

Legislative Update Gives Exemption to New California Limited Liability Companies LLCs registered to do business in California must pay an annual franchise tax of $800 to the state's Franchise Tax Board (FTB). However, to relieve some of the financial pressures amid the pandemic for newly formed businesses, California Governor Gavin Newsome signed legislation in 2020 to exempt startups from paying the LLC franchise tax during their first year in business. This is welcome news for aspiring business owners in the Golden State! The new rules established by the state’s 2020 Budget Act (AB 85)...

Do You Need an LLC for Rental Property in Another State?

No matter where you’re buying a rental property, protecting that investment is important. Many real estate investors who own rentals choose to set up each of their properties as a Limited Liability Company (LLC). Doing so helps protect their personal assets from mishaps or accidents at their rental locations. But do you really need an LLC for rental property in another state? And, where is it most advantageous to register an LLC when buying real estate property out of state? Is it in the investor’s home state or where the rental property resides? In this article, I’ll provide some food...

Hiring Family Members in a Small Business

I'm often asked if it is advantageous for a small business to hire family members. Some entrepreneurs have asked if hiring relatives presents legal issues, while others have asked if it is ethical. Whether you believe this practice is good business or nepotism, there are a lot of companies hiring relatives in full-time and contract positions. In the U.S. today, there are 5.5 million family-owned businesses, employing 63% of the American workforce. That adds up to many family business owners working with family members. These scenarios could be fraught with angst or, if done right, lead to...

What is a Certificate of Incorporation?

When forming a C Corporation, business owners need to file for a Certificate of Incorporation (sometimes referred to as Articles of Incorporation) to register their company with the state. What is a Certificate of Incorporation exactly? It is a legal document serving as a formal record of a company’s formation. Who Needs to Submit a Certificate of Incorporation? Entrepreneurs who want to operate their company as a corporation must file a Certificate of Incorporation form. They must have their Certificate of Incorporation approved by the state (usually the Secretary of State Office) before...

What Is a Reseller License?

If you’re starting a retail business (whether online or at a brick and mortar location), you’ll want to apply for a reseller license. A reseller license certifies you don’t have to pay sales tax when buying products on a wholesale basis for the purpose of reselling them to customers. In some states, a reseller license might alternately be called a reseller permit, resale license, resale certificate, sales tax permit, or some other term. Regardless of its name, its purpose is to identify your company as a reseller. Reseller License and Sales Tax In the United States, a business with a...

Be Your Own Boss: 17 At Home Business Ideas

One of the challenges of running a home-based business is deciding what type of business to start in the first place! With so much to consider, where do you begin? First, think about your definition of a home-based business. Do you define it as having your office and performing your work at your house? Or is it having an office at home but carrying out most of your work at another site or your customers’ locations? In this article, I’ll focus on at-home business ideas that allow an entrepreneur to have their office and perform most of their work within their home. I’ll also answer some...

How to Move A Business To Another State

When you move from one house to another, you likely have a checklist of things you need to take care of in the process from changing your mailing address and calling your cable TV provider and your internet company. But when moving your business to another state, many business owners don’t know where to begin. There are many reasons to consider moving your business to another state. For example: Your target market has changed—economically and/or demographically. The cost of real estate (including property taxes) has risen so much that your business is at risk of going under. The state has...

How to Start a Vending Machine Business

The vending machine industry is one that has evolved and steadily grown over the last decade. As consumers' lives get busier and people seek convenience and time-saving options while on the go, vending machine operators have many opportunities. According to Research and Markets, the global vending machine market size was estimated at $21.3 billion in 2020 and it is expected to reach $31 billion by 2027. That is a growth rate of 5.5%. The U.S. vending machine market is estimated at $5.8 billion with a growth rate of 8.9%. Those numbers are impressive and they are fueling Americans' desire...

11 Businesses to Start With $10K

Many entrepreneurs begin successful companies without piles of money in the bank. In fact, some businesses can get off the ground with $10K or less. So, if you’re dreaming of being your own boss but have limited funds, keep your chin up! In this article, I’ll touch on some low-cost business ideas to consider, how to start a business, what costs to expect, and tips for starting a business on a shoestring budget. Low Startup Cost Business Ideas Here are some types of entrepreneurial endeavors that can typically be launched without a lot of cash. Some require specific talents, while others...