The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

Four Common Types of Corporations

Incorporating a business provides many benefits for companies of all types and sizes. The process requires filing paperwork and paying a fee to have the state recognize the business as an official entity. Before deciding on a specific type of Corporation, you should think through several considerations that include: Where business will be conducted Wanting to have limited personal liability for business activities Whether the business will have a partner or an investor The company’s expected earnings and deductions Desire to minimize self-employment tax obligation Business goals Tolerance...

How to Start a Business in Georgia

In 2024, personal finance company WalletHub ranked Georgia as the second-best state in the country for business formation. Reasons include one of the highest rates of entrepreneurship, a prevalence of interconnected businesses, exceptional growth potential, and a low corporate tax rate. If you’re thinking about starting a business in Georgia, there are some factors specific to that state that you’ll need to consider. In this article, I’ll walk you through everything you need to know to get your business up and running. 1. Fine-tune Your Business Idea Before you start filing paperwork and...

Member Managed vs Manager Managed LLC

Of the more than 30 million small businesses in the United States, 35% are Limited Liability Companies (LLCs), according to the Small Business Administration. LLCs are a popular business entity for a number of reasons. They’re relatively easy to get up and running and normally not overly difficult to maintain in terms of licensing, filing annual reports, and performing other tasks necessary to remain in compliance. They provide flexibility in how the business is taxed and shield members from personal liability. Also, LLC members are able to decide how the company will be managed. An LLC...

Is State Unemployment Insurance Required?

At any time, a percentage of the labor force is unemployed for various reasons. According to the United States Department of Labor, 6.4 million (3.8%) people across the U.S. were unemployed in March 2024. State unemployment insurance is a critical support program that helps individuals who lose their jobs through no fault of their own, providing a source of income while they search for another position. Since 2007, there have typically been two to five million active UI claims on any given day, according to data from the Bureau of Labor Statistics. During the pandemic, claims rose to...

What Is a Statutory Agent?

A statutory agent, more commonly known as a registered agent, agent for service of process, or a resident agent. It is an individual or entity appointed by a Limited Liability Company, S Corporation, C Corporation, or other legal business entity to accept legal documents, government correspondence, and compliance paperwork on its behalf. Statutory agents are critical for keeping statutory (state-registered) business entities in compliance with a state’s laws, which is why states require business entities to designate one. This is done when completing their registration forms to conduct...

DBA vs. LLC: What’s the Difference?

If you’re starting a new businessm adding new locations, or adding business lines, you are likely wondering if registering a DBA or forming an LLC is the best route to travel. A DBA is an assumed (fictitious) name that an existing business has received approval to use when conducting business. An LLC is a registered business entity. Both options provide a way to operate under a business name other than a company’s legal name. But in addition to that similarity, they have significant differences. Choosing one or the other affects a company’s costs, compliance requirements, and other...

Is a Farm LLC Really Necessary?

Starting and running a farming business provides the opportunity and the freedom to forge your own professional path. There’s hard work involved and any seasoned farmer will tell you farming is a 24/7 commitment. And an agricultural business comes with many of the same risks that other types of companies do, and some that other types of businesses do not. A farming business faces many uncontrollable threats such as economic downturns, droughts, floods, illness, accidents related to the use of large equipment, or unseasonable freezing weather. That’s why it’s critical to consider what...

Do Uber Drivers Need an LLC?

Uber drivers, even those doing rideshare driving as a side gig, are considered to be earning income through self-employment. Just like other self-employed independent contractors, they face some critical startup decisions—including what business entity type to choose for their business. After signing the Uber contract to designate themselves as a self-employed private contractor, Uber drivers face the decision of what type of business structure they should operate under. And they shouldn’t take this lightly, because the business structure chosen will affect their tax obligations and...

7 Real Reasons Why You Need a Dedicated Business Bank Account

Whether you operate a Sole Proprietorship, Partnership, Limited Liability Company (LLC), Limited Liability Partnership (LLP), or Corporation, how you manage your finances is a vital aspect of running your business. While using your personal bank account for business might seem like the simplest solution, it’s not a good idea for a variety of reasons. Mixing your business and personal finances can result in problems ranging from tax consequences to your business appearing to be unprofessional. Let’s take a deeper dive into some reasons why keeping your business and personal bank accounts...

Do You Have a Domestic or Foreign LLC?

A domestic and foreign LLC refers to the state where the LLC is created. Registering your business as a foreign LLC (also known as a foreign qualification) is required under certain circumstances when you operate your business outside of the state in which you’ve formed your LLC. The purpose of registering is to meet the regulatory and tax requirements of the foreign state. Despite the term "foreign", a foreign LLC operates domestically within the United States. Your LLC isn’t considered foreign in the state where you initially registered it, only in the states where you’ve expanded its...

Kentucky Annual Reports: When They’re Due and How to File Them

In Kentucky, Limited Liability Companies, C Corporations, Limited Partnerships, and Business Trusts must file an annual report with the Kentucky Secretary of State office. Businesses operating as Sole Proprietors or General Partnerships do not have to file. Kentucky annual reports allow the State to provide accurate information to the public about the business entities registered there. Registered entities must file their report each year—even if they had no business activity or income. The report due date, regardless of entity type, is June 30 and businesses may file anytime between...

7 Things to Know About Florida’s Annual Report

If you have incorporated in Florida or formed an LLC in Florida, your deadline for filing your Annual Report is May 1. Here are 7 facts that you need to know to ensure that your corporation or LLC remains compliant in the state of Florida.

You Must File an Annual Report Whether Your Business Has Changes or Not

While the purpose of the Annual Report is to ensure that the Florida Department of State, Division of Corporations has your company’s most updated information, you still have to file the document, even if you have no changes since last year.

Businesses Incorporated in Texas Need to Fill Out an Annual Report By May 15

That’s the date your Annual Report — also called Franchise Tax Report — is due. Here’s what you need to know to ensure that you stay compliant with the state of Texas.

How to Obtain a Certificate of Existence for Your Georgia Business

If you own a Limited Liability Company, C Corporation, or other registered business entity in Georgia and you want to open a business bank account, expand your business into another state, seek funds from investors, or conduct certain other business activities, you’ll need to have a Certificate of Existence. A Certificate of Existence, known in some states as a Certificate of Good Standing or Certificate of Subsistence, is a document obtained through the Corporations Division of the Office of the Secretary of State. It verifies that your business is properly registered; up to date on...

West Virginia Annual Report: Are You in Compliance?

Most types of businesses operating in West Virginia must file an annual report with the Secretary of State Office to keep their company records updated. The deadline for submitting the report, along with the associated filing fee, is July 1 each year after the initial registration of the business entity. Business owners in West Virginia (and those wishing to expand operations from another state to WV) can benefit from talking with an attorney and accountant or tax advisor about whether they need to submit an annual report. Moreover, consulting with trusted professionals can shed light on...

Certificate of Subsistence: What It Is and Why You Might Need One

If you own a business that’s registered with the state in which you operate, such as a Limited Liability Company, a C Corporation, or a Limited Liability Partnership, it’s likely that at some point you’ll be asked to provide a Certificate of Subsistence. A Certificate of Subsistence, which in some states is known as a Certificate of Good Standing, a Certificate of Existence, or a Certificate of Status, is a document from the state that verifies a business is indeed operating; is properly registered; and is in compliance with federal, state, and local laws. While specific information...

How to Hire Temporary Employees

If the bed-and-breakfast you own and operate runs at full capacity for the months of July and August and the work is too much for you to do on your own, you might consider hiring temporary employees to help. The same goes for a consulting firm that just landed an important six-month assignment for its biggest client, or a building contractor who agreed to take on a large-scale renovation project. Temporary workers account for only about 2% of total nonfarm employment in the United States, according to the Bureau of Labor Statistics, but employers in many industries rely on temporary...

How to File Taxes as a Limited Liability Partnership

If your startup will have more than one business owner, you have several choices for how to legally structure your company. In today’s post, I’ll discuss the Limited Liability Partnership (LLP), which is a type of partnership that isn’t as widely known as the General Partnership or Limited Partnership business structures. The following information will help you understand what an LLP is, how an LLP is taxed, and the basic steps for creating one. Before we get into all that, I want to remind you that the type of business entity you select will affect just about every aspect of launching...

Obtain Asset Protection for Your Business

One of the main reasons to create an LLC or to incorporate revolves around asset protection. The business structure legally separates the assets of the ownership from the assets of the company. The corporation may be sued (and even go bankrupt) without loss of personal property by the ownership. As your first line of defense, I encourage you to consider the legal structure of your business. If you’re operating as a sole proprietorship (or general partnership), you’re more likely to put your personal belongings in jeopardy than if you formally register your business as a different type of...

Choosing a Business Structure

Choosing a business structure for your company is one of the most crucial first steps to starting a business. Your business entity type has legal, financial, and administrative implications, so it’s important you get started with the best entity for your situation.Some of the factors that will influence which business entity type you select include: Where you plan to conduct your business Wanting to have limited personal liability for your business activities Whether you will have a partner or an investor Your expected earnings and deductions Desire to minimize your self-employment tax...

Do You Need an LLC for Your Rental Properties?

Most builders and real estate investors understand the importance of protecting personal assets and optimizing their tax situation. One way to address both concerns is by choosing the right business structure for holding rental properties. Many property developers and investors choose a Limited Liability Company (LLC) for their rental properties because the LLC provides asset protection and tax flexibility. LLCs are separate legal entities from their owners (called “members”). They can have one member (single-member) or more than one member (multi-member). By setting up individual...

What Is an Anonymous LLC?

While it may sound mysterious and intriguing, an anonymous LLC (also known as a private or confidential LLC) is like a regular Limited Liability Company, except its members are not publicly identified by the state. The names, addresses, and contact information for members remain private and do not become part of the public record or get published on the state website. Not all states grant LLC owners anonymity. But depending on the circumstances, business owners in a state that prohibits anonymous LLCs may be able to form one in a state that does allow them. Discussing your needs and...

How Often Does an LLC Pay Taxes?

If you’re considering starting a Limited Liability Company (LLC) or restructuring your business as an LLC, it’s important to know what taxes you’re responsible for, when your taxes are due, and how to file taxes for your business entity. Keep in mind that an LLC’s tax obligations can vary greatly. Multiple factors affect an LLC’s tax filing responsibilities. For example: Does the LLC have one sole owner (Single-Member LLC)) or two or more owners (Multi-Member LLC)? Has the LLC elected to have S Corporation or C Corporation tax treatment? What are the state and local income and sales tax...

Most Popular Franchise Businesses

If the thought of starting your own business seems overwhelming, there’s an option you could consider to streamline the start-up process and make it more workable. Instead of starting from scratch to build an independent business, you could consider franchising. Franchising is a business model in which an independent party buys into an established business and opens and runs their own location. It’s a popular model because it enables the established business to grow while giving an entrepreneur just starting out the advantage of being associated with a known company. The franchisor—the...

How Do You Pay Yourself as a Sole Proprietor?

Many small business owners start their companies as Sole Proprietorships. The business structure offers setup simplicity, cost-effectiveness, and minimal business compliance requirements. To determine if a Sole Proprietorship is right for them, entrepreneurs should consider the pros, cons, and nuances associated with it. In this article, I’ll discuss what a Sole Proprietorship is, how sole proprietors pay themselves, how to pay taxes in a Sole Proprietorship, and examine some potential benefits of switching to an LLC instead. What Is a Sole Proprietorship? The IRS defines a Sole...

A Guide to Filing a North Carolina Annual Report

Filing a North Carolina annual report is a yearly activity that is required to maintain your company's registration as a legal entity in the state. It contains information about the company and is due whether or not the entity is actively conducting business. The only time a company no longer has to submit an annual report is when it has been officially dissolved with the state. Who Must File an Annual Report? The following foreign and domestic companies must file an annual report to the North Carolina Secretary of State: C Corporations Limited Liability Companes (LLC) Limited Liability...

Does Your Business Have to File a Georgia Annual Report by April 1st?

Business entities that are registered with Georgia's Office of the Secretary of State must file a Georgia annual report each year. The due date for filing Georgia's annual report is April 1st. What is an Annual Report? The correct terminology for an annual report is actually "annual registration." However, many people refer to it as an "annual report" because that's what the annual filing is called in many states. Throughout this article, you'll see that I use both terms to mix things up a little for your reading pleasure! Businesses required to file a Georgia annual registration must do...

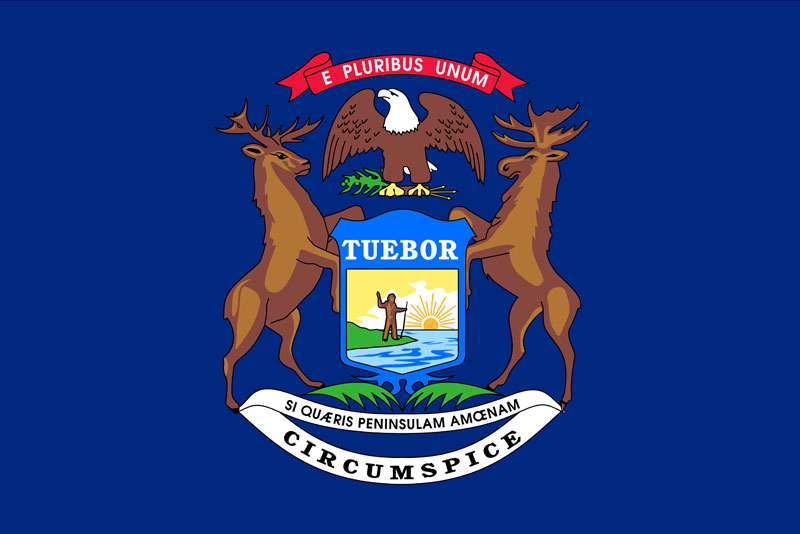

Michigan Annual Report Filing for LLCs and Corporations

The state of Michigan requires all business owners of limited liability companies (LLC) and corporations to file an annual report. An annual report is a filing that helps ensure the state's records about a business entity are accurate. Michigan has specific due dates for filing annual reports, so entrepreneurs need to stay on top of the deadlines and get their paperwork turned in on time. Submitting annual reports is one of the compliance tasks required to keep business entities in good standing with the state. In this post, we’ll cover general details about Michigan’s requirements for...

How to Perform a Business Name Search for Any State in the US

Along with deciding whether your company will operate as a Sole Proprietorship, Limited Liability Company (LLC), General Partnership, C Corporation, or S Corporation, selecting the right name for your new business is an important early step. And while choosing a name might sound like an easy, straightforward task, it’s imperative that you spend some time and effort making sure you follow the rules laid out by your state. One of the most important tasks is to make sure the name you choose isn’t already taken. Taking a name that’s already in use can result in confusion, or worse yet, legal...

Can You Turn a DBA into an LLC?

Many business owners who operate as a Sole Proprietorship or Partnership use a DBA (Doing Business As) name to market their business more effectively and present a more professional image. A DBA can serve a business well, but it’s important to realize it is just a name. A DBA is not a business entity and does not provide any liability or asset protection for entrepreneurs as a Limited Liability Company (LLC) does. What if you’ve been running your business as a Sole Proprietorship or Partnership and you’d like to switch to an LLC but continue using your DBA name? Can you turn your DBA into...