The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

12 Examples of Sole Proprietorships

A large range of businesses operate as Sole Proprietorships – a type of business entity that has one person, or a married couple, as its owner and operator. In fact, there are more Sole Proprietorships in the United States than any other type of business structure, including Limited Liability Companies (LLCs) or C Corporations. Sole Proprietorships are popular because they’re easy and inexpensive to get started. If someone hires you to bake their wedding cake, tend to their landscaping, or tutor their child in math, you’ve, by default, established a Sole Proprietorship. There’s no need to...

How to Start Your Own Business

The U.S. Chamber of Commerce reports that more than 5.5 million new business applications were filed in the United States in 2023. This record number has continued to grow since the surged started in 2020. If you’re one of the millions of Americans with a dream of starting your own business, I’m happy you to say you're in good company. As someone who has formed a number of small businesses, I’d like to provide some advice and walk you through the steps of getting started. Opening your own company, whether it’s a Sole Proprietorship, Partnership, Limited Liability Company (LLC), or C...

Is a Multi-Member LLC Right For You?

Are you starting a business with some colleagues or friends? Or do you have an existing business and want to add some partners so you can grow your company? In either case, the multi-member LLC business structure may be a good option to consider. A multi-member LLC is a Limited Liability Company with more than one owner. It is a separate legal entity from its owners (a.k.a. members), while by default, income tax obligations are on a pass-through basis to the LLC’s members (similar to Partnership). Let’s take a closer look at why many companies with multiple owners choose the entity type....

Does an S Corporation Need to File Articles of Organization?

If you’ve spent any time on this blog or researching how to incorporate your business online, you’ve probably found some terms that were a bit confusing. What’s the difference between an LLC and a C Corporation? What paperwork do I need to file annually? What are Articles of Organization, and do I need them? Bringing S Corporation elections into the discussion only creates more confusion. Let’s address that last question and talk about filing Articles of Organization for S Corporations. While the Limited Liability Company (LLC) and C Corporation are different, they both provide similar...

Forming a Sole Proprietorship

If you’re looking to start your own business, a Sole Proprietorship is an easy way to get started. A Sole Proprietorship is a simple business entity in which one person, or a married couple, acts as the sole owner and operator. Unlike a C Corporation or Limited Liability Company (LLC), you don’t have to register a Sole Proprietorship with the state or file an annual report and pay a fee each year to maintain good standing. Basically, you can form a Sole Proprietorship simply by having someone hire you to provide a product or service. By doing so without registering your business with your...

Business License vs. Permit

You might hear the terms “business license” and “business permit” used interchangeably. Although they are similar in that a company may need them to conduct business in a particular area, they aren’t exactly the same. Business licenses and permits help ensure that companies operate lawfully and safely. Generally speaking, a business license gives a company the legal authority to operate a business in a specified area while a permit provides permission (typically based on meeting certain safety requirements) to carry out specific activities at a location. Operating without the appropriate...

When Do You Need to Start Paying Sales Tax on Online Sales?

Understanding sales tax responsibilities can be confusing. For businesses with a brick-and-mortar storefront, it’s relatively straightforward. However, the rules get hazy when selling online to customers in other states. Let's review what you need to know about what online sales you need to tax and when you need to do so. What You Need to Know About In-State Sales Tax Before I get into details about selling online, here’s a quick overview of how sales tax works in-state. In simple terms, sales tax is a tax imposed by the state (and/or county or city) on taxable goods or services sold in...

Business Filings for Growing Your Company

Are you aspiring to elevate your business to the next level? Are you expanding your products and services, bringing in new partners, entering into new markets, or adding employees? You might want to complete some important business filings before you take those next steps. Depending on your circumstances and growth strategy, some filings may be optional, while others could be legally required. In this article, I’ll identify some filings commonly associated with growing a business. Incorporation As businesses grow, often so do their liability risks. So, if you’re operating a Sole...

How to Change Your LLC Address

If your Limited Liability Company (LLC) has outgrown its space or you’ve been operating from your home and are ready to move the business to another location, you’ll need to notify certain parties of your address change and update your operating agreement. Changing your business address doesn’t sound like a big deal, but not doing so correctly could make it a big deal in terms of consequences. Tax and licensing agencies need to keep track of where businesses are operating and don’t look kindly on those that fail to report address changes. In fact, not reporting a change of address could...

The Advantages and Disadvantages of a Subchapter S Corporation

Before the advent of the S Corporation in 1958, entrepreneurs had two options for forming a business entity. They could form a Partnership or a C Corporation, but neither of those business structures fulfilled the needs of many people seeking to start their own businesses. To help encourage small businesses in America, Congress and President Eisenhower created the Subchapter S Corporation. Whether you're a business owner or a professional service provider that gives entrepreneurs legal or tax advice, you'll want to understand what a Subchapter S Corporation is and who can benefit from it....

S Corporation Election Considerations for Corporations and LLCs

Have you been thinking about whether your business might benefit from being an S Corporation? I presented a webinar for accounting professionals about the S Corporation election not too long ago. Within that presentation, I covered information of value to entrepreneurs in all fields. In this article, I will share that insight with you in hopes that it will help you gain a deeper understanding of what it means to be an S Corporation. What Is an S Corporation? The S Corporation is not a business structure in itself. Rather, it is a special federal income tax election option for eligible...

State of Colorado Periodic Report

All Corporations, Limited Liability Companies (LLCs), Non-Profit Corporations, and foreign entities registered to conduct business in the State of Colorado must file a periodic report each year with the Colorado Secretary of State’s Business Division. The intent of the report, which in some states is called an annual report, is to make sure the state and members of the public have the most up-to-date information about every reporting company that conducts business in Colorado. Filing the report is not difficult, but you must pay close attention to guidelines, as not doing so could result...

Delaware LLC Franchise Tax

Delaware is known as a business-friendly state for such reasons including its lack of residency requirements, favorable tax structures, legal flexibility, privacy protections, and other advantages. A less friendly aspect of having your LLC based in Delaware is its franchise tax, which is a fee that owners of Limited Liability Companies (LLCs) and some other types of business entities must pay each year for the privilege of having their companies located in the state. Even if you formed your LLC in Delaware to take advantage of its business-friendly reputation but conduct all your business...

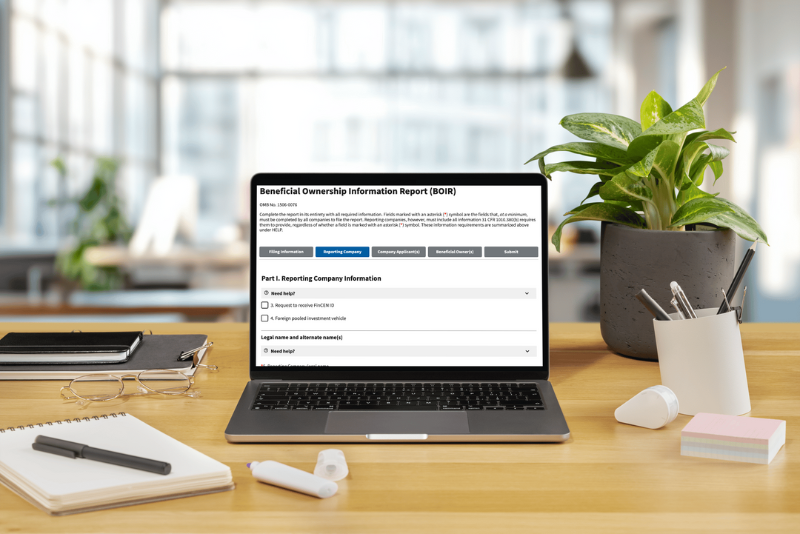

FinCEN Announces that BOI Reporting Is Voluntary (For Now Anyway)

If you’re feeling a bit of whiplash from the wild ride that is the federal court activity related to the Corporate Transparency Act’s Beneficial Ownership Information Reporting (BOIR) Rule, we understand! Just days after FinCEN announced on December 23, 2024 that an injunction temporarily suspending mandatory BOIR was lifted and reporting companies again must file their reports by the required deadline (which was extended to January 13, 2025, for existing entities), things took a sharp turn. On December 26, 2024, a panel of the same U.S. Court of Appeals for the Fifth Circuit that...

The S Corporation Election Deadline is Right Around the Corner

The S Corporation election deadline for LLCs and C Corporations is March 17, 2025. So, if you’re considering changing your limited liability company or C Corporation tax treatment from its default status to an S Corporation, time is of the essence! To be considered an S Corporation for tax purposes in 2025, existing LLCs and C Corporations must file their election within two months and 15 days (within 75 days total) after the start of their 2025 tax year. For example, a company with a tax year that began on January 1, 2025, must file IRS form 2553 no later than March 17, 2025....

Can a Single-Member LLC Add Members?

If you’re wondering if you can bring additional members into your single-member LLC, the answer if yes. There are steps you can take to add members, at which point your business would become a multi-member LLC. There’s more to that question than you might think, however, so I’d like to take some time to walk you through the ins and outs of increasing membership in your Limited Liability Company. Let’s start by reviewing what occurred when you formed your business, and then we’ll look at some pros and cons of adding one or more members. Single-Member LLC Refresher A single-member LLC is a...

Year End Small Business Tax Tips to Reduce Tax Payments in 2025

Before you let the hustle and bustle of the holiday season take over your business (and your life), now’s a good time to review your financial situation and explore some money-saving small business tax tips. Below is a list of my top tax tips entrepreneurs can still benefit from at year-end. 1. Deduct Startup Expenses Did you start your business this year? You may be able to claim some of your startup expenses on your tax return in the year you actually opened the business. To qualify as a startup expense (a capital cost), the IRS requires the expense to meet two requirements: The expense...

Federal Court of Appeals Reinstates Enforcement of BOI Reporting Requirement

Throughout the year, we have provided several updates about the 2024 Beneficial Ownership Information Reporting mandate. Recently, there’s another development you should be aware of. The temporary suspension of the BOI reporting rule has been lifted, and reporting companies are once again required to file BOI reports. On December 23, 2024, the federal Court of Appeals decided to end the preliminary injunction (effective December 3) that suspended the U.S. Treasury Department and FinCEN from enforcing the Corporate Transparency Act (CTA) and its BOI reporting requirements. This means...

How to Remove a Member from an LLC

Some limited liability companies undergo ownership changes as their businesses evolve. Members may come or go — either voluntarily or involuntarily — for a variety of reasons. So how do you remove a member of an LLC? Well, that depends! Different circumstances can affect the process and the outcomes for what happens to a member’s ownership interests in the company. Whether an LLC’s members want one of their members gone, a member wants to withdraw voluntarily, or a member passes away, the company must carry out the process lawfully. Ideally, an LLC’s organizational documents or LLC...

Should You Incorporate at Year End or Wait Until 2025?

If you’re gearing up to incorporate and get your business off the ground at the start of 2025, you might wonder when to file your business formation paperwork. Can you submit your incorporation forms now and request an effective date that is delayed? After all, the end of December tends to be ultra-busy. Trying to complete all the forms and manage all the details amid that chaos will only compound the stress. Choosing the right business entity type for your business is a critical decision, and so is determining when to file your forms with the state. In this article, I’ll give you...

When to Incorporate a Startup

If you’ve been operating your business as a Sole Proprietorship, you may be wondering when’s the right time to incorporate your startup as a bona fide business entity. There are various reasons to consider incorporation and its important to know your timing can matter! Five Signs It's Time to Incorporate Naturally, every company’s situation is different, so various factors play a role in determining the ideal time to register a business entity. Circumstances when forming an LLC or Corporation may be advantageous for a startup include the following items. 1. Conducting Business Activities...

What Business Owners Need to Know About Filing Taxes in 2025

The new year is right around the corner, which means businesses across the United States need to start thinking about filing taxes for 2024 It’s time to determine deadlines and research any legislative and tax code changes that may affect you and your company. For guidance in preparing your 2024 tax return, I encourage you to talk with a professional tax expert. In the meantime, here’s a quick overview of what business owners should consider when filing their taxes in 2025 Sole Proprietorship Taxes Sole Proprietorships are unincorporated businesses with no distinction between the business...

What is a Commercial Registered Agent?

Choosing a commercial registered agent provides advantages that can significantly benefit your business and help make sure your company remains in compliance with all laws and regulations. If you have a Corporation, Limited Liability Company (LLC), Limited Partnership, Limited Liability Partnership (LLP), or other business that’s registered with the state, you’re required to have a registered agent in that state. If your company conducts business in states other than the one in which it was originally registered, you’ll need to have a registered agent in each of those states, as well. The...

Court Rules to Temporarily Suspend Enforcement of BOI Reporting Requirement

Throughout the year, we have provided several updates about the 2024 Beneficial Ownership Information Reporting mandate. Recently, there’s another development you should be aware of. If you haven’t already submitted your BOI report to FinCEN, you’ll want to carefully consider the announcement and its potential impact. On December 3, 2024, the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction, suspending the U.S. Treasury Department and FinCEN from enforcing the Corporate Transparency Act (CTA) and its BOI reporting requirements. This court...

What is a Franchise Tax?

A franchise tax is a fee that some states charge businesses for the right to conduct business within the state. Less than half of all U.S. states levy a franchise tax on businesses like C Corporations and Limited Liability Companies. States that do impose this "privilege tax" have different rates and rules pertaining to it. Some states exempt certain types of businesses, such as nonprofits from having to pay the tax. And some companies operating within a certain industry that’s considered beneficial, such as renewable energy, may also be exempt. Also, businesses that are not registered...

How to Keep Your LLC Compliant

Running a business and staying up to date with LLC compliance can be a bit overwhelming for many entrepreneurs. There are a lot legal requirements at the federal, state, and local level to track and take action on throughout the year. And to make matters worse, the requirements can vary depending on where the company is located, the industry, its business activities, whether it has employees, and other factors. As we venture into the last few weeks of the year, I'd like to provide a recap of the primary LLC compliance items you need to be aware of, and most likely, take action on before...

How to Record the Buyout of a Partner

Sometimes business partnerships just don’t work out. Whether it’s due to disagreements or because one partner wants to pursue other opportunities, it’s essential to know what your options are when it’s time to split up a partnership. One common scenario is when one partner wants out, but the other partner (or partners) wants to continue the business. In that case, a partner buyout is a likely solution. Knowing the proper way to buy out a business partner will save you time, money, and a lot of hassle in the future. Here’s what you should know about a partner buyout. The Importance of a...

Expanding a Small Business to Another State: What You Need to Know

Extending your small business’s presence across state lines can help your company reach new markets, grow revenue, and boost profits. But how do you expand a small business into another state? And what’s involved in operating a business in multiple states? There are some filing requirements to operate in other states legally and tax-related considerations that need attention. Of course, none of that should be taken lightly, so entrepreneurs should research the requirements of the state(s) where they want to conduct business. It’s also beneficial to consult an attorney and tax advisor or...

What You Need to Know About Collecting Sales Tax

Before a retailer or service provider can open for business, they first must get approval from the state for sales tax registration. Not all states charge sales tax, and not all products and services are taxable, so it’s essential to learn the facts before you find yourself in compliance hot water. Here’s what to know about your business’s responsibilities regarding the collection of sales taxes. Sales Tax Vary by State and Sometimes by County Currently, forty-five states and the District of Columbia collect statewide sales taxes, while five states do not have a statewide sales tax. The...

LLC Dissolution vs. Termination

Businesses open and close all the time. The U.S. Small Business Administration reports that between March 2021 and March 2022 about 1.2 million small businesses opened and approximately 834,000 closed. If you’re faced with closing your Limited Liability Company (LLC), there are steps you’ll need to take to make sure it’s done legally. Failing to do so can cost you money and result in negative consequences down the road. While the words dissolution and termination are often used interchangeably when referring to closing an a business, they have different legal meanings and refer to two...