The Launch Blog: Expert Advice from the CorpNet Team

Do You Need an LLC for Rental Property in Another State?

No matter where you’re buying a rental property, protecting that investment is important. Many real estate investors who own rentals choose to set up each of their properties as a Limited Liability Company (LLC). Doing so helps protect their personal assets from mishaps or accidents at their rental locations. But do you really need an LLC for rental property in another state? And, where is it most advantageous to register an LLC when buying real estate property out of state? Is it in the investor’s home state or where the rental property resides? In this article, I’ll provide some food...

Hiring Family Members in a Small Business

I'm often asked if it is advantageous for a small business to hire family members. Some entrepreneurs have asked if hiring relatives presents legal issues, while others have asked if it is ethical. Whether you believe this practice is good business or nepotism, there are a lot of companies hiring relatives in full-time and contract positions. In the U.S. today, there are 5.5 million family-owned businesses, employing 63% of the American workforce. That adds up to many family business owners working with family members. These scenarios could be fraught with angst or, if done right, lead to...

Who Are the Officers of a Corporation?

A corporation has three main categories of stakeholders involved in the financial and management aspects of the company. While all play a crucial role, officers work more closely with a corporation’s managers and supervisors, arguably having a more direct impact on the company’s success. Officers - Officers are individuals appointed by the board of directors to manage the corporation. They act as agents of the board to ensure the organization carries out the directors’ decisions. Corporate officers’ roles and the number of officers can vary based on state law and the company’s governance...

What is a Certificate of Incorporation?

When forming a C Corporation, business owners need to file for a Certificate of Incorporation (sometimes referred to as Articles of Incorporation) to register their company with the state. What is a Certificate of Incorporation exactly? It is a legal document serving as a formal record of a company’s formation. Who Needs to Submit a Certificate of Incorporation? Entrepreneurs who want to operate their company as a corporation must file a Certificate of Incorporation form. They must have their Certificate of Incorporation approved by the state (usually the Secretary of State Office) before...

What Is a Reseller License?

If you’re starting a retail business (whether online or at a brick and mortar location), you’ll want to apply for a reseller license. A reseller license certifies you don’t have to pay sales tax when buying products on a wholesale basis for the purpose of reselling them to customers. In some states, a reseller license might alternately be called a reseller permit, resale license, resale certificate, sales tax permit, or some other term. Regardless of its name, its purpose is to identify your company as a reseller. Reseller License and Sales Tax In the United States, a business with a...

Be Your Own Boss: 17 At Home Business Ideas

One of the challenges of running a home-based business is deciding what type of business to start in the first place! With so much to consider, where do you begin? First, think about your definition of a home-based business. Do you define it as having your office and performing your work at your house? Or is it having an office at home but carrying out most of your work at another site or your customers’ locations? In this article, I’ll focus on at-home business ideas that allow an entrepreneur to have their office and perform most of their work within their home. I’ll also answer some...

How to Move A Business To Another State

When you move from one house to another, you likely have a checklist of things you need to take care of in the process from changing your mailing address and calling your cable TV provider and your internet company. But when moving your business to another state, many business owners don’t know where to begin. There are many reasons to consider moving your business to another state. For example: Your target market has changed—economically and/or demographically. The cost of real estate (including property taxes) has risen so much that your business is at risk of going under. The state has...

How to Start a Vending Machine Business

The vending machine industry is one that has evolved and steadily grown over the last decade. As consumers' lives get busier and people seek convenience and time-saving options while on the go, vending machine operators have many opportunities. According to Research and Markets, the global vending machine market size was estimated at $21.3 billion in 2020 and it is expected to reach $31 billion by 2027. That is a growth rate of 5.5%. The U.S. vending machine market is estimated at $5.8 billion with a growth rate of 8.9%. Those numbers are impressive and they are fueling Americans' desire...

11 Businesses to Start With $10K

Many entrepreneurs begin successful companies without piles of money in the bank. In fact, some businesses can get off the ground with $10K or less. So, if you’re dreaming of being your own boss but have limited funds, keep your chin up! In this article, I’ll touch on some low-cost business ideas to consider, how to start a business, what costs to expect, and tips for starting a business on a shoestring budget. Low Startup Cost Business Ideas Here are some types of entrepreneurial endeavors that can typically be launched without a lot of cash. Some require specific talents, while others...

Do LLC Owners Pay Self-Employment Tax?

Many small business owners choose to operate their companies under the LLC business structure. They do so with good reason! The LLC offers liability protection to its owners (members), tax flexibility, and compliance simplicity. However, that tax flexibility may cause some confusion for entrepreneurs. One of the tax-related topics that people often ask about is if LLC members have to pay self-employment tax. In this article, I'm going to cover that question, along with many others related to the subject. FAQs About LLCs and Self-Employment Tax Is Self-Employment Tax the Same as Income...

Adding Partners to an LLC

When growing your Limited Liability Company (LLC), you may come to the point where you want to add a partner (or partners) to help you scale your business. Whether you’re looking for an injection of capital, some with specialized knowledge or skills, or want to reward loyal employees, adding new LLC partners is fairly simple as long as you follow the rules required by your state and as stated in your LLC operating agreement. LLC owners are called members, so when you’re adding new partners, you’re actually adding new members to your company. How you add partners depends on the kind of LLC...

C Corporation Tax Rates

There are many reasons companies choose to incorporate as C Corporations. Being a C Corporation is preferred if you plan to seek investors or take the company public. Also, because the C Corporation is a legal, taxable entity separate from its owners, shareholders’ personal liability is limited to the amount they have invested in the company. In contrast, owners of Sole Proprietorships and Partnerships are personally liable for the business’s debts and legal issues. Although becoming a C Corporation involves more paperwork and continuous compliance, many business owners find the C...

How to Record the Buyout of a Partner

Sometimes business partnerships just don’t work out. Whether it’s due to disagreements or because one partner wants to pursue other opportunities, it’s essential to know what your options are when it’s time to split up a partnership. One common scenario is when one partner wants out, but the other partner (or partners) wants to continue the business. In that case, a partner buyout is a likely solution. Knowing the proper way to buy out a business partner will save you time, money, and a lot of hassle in the future. Here’s what you should know about a partner buyout. The Importance of a...

Can a Nonprofit Have a DBA?

Sometimes business owners want to market their services or products under a name other than their legal business name. For instance, a Sole Proprietorship, who must have both the owner’s first and last name in the business name, will want to use a fictitious name that’s more creative and compelling. They have to get permission to use that fictitious name by filing a DBA (doing business as). But other business entities, such as Nonprofit Corporations, may also have reasons for using a DBA. If you're wondering if a Nonprofit Corporation can register a DBA, the answer is yes and I’ll cover...

The Ultimate Checklist for Starting a Business in New York

New York is a great place to start a business and begin your journey of entrepreneurship. This article will walk you through the many things business owners should know and address to get their new businesses up and running.

The Difference Between a Business Entity Statutory Conversion and Business Domestication

Statutory conversion vs. business domestication. One changes a business entity type; the other changes a company's home state. Read on to learn more!

CorpNet Awarded Inc. Pacific Regionals for 2023

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. Regionals Pacific list in 2023 as one of the fastest-growing private companies in the country. This is the second year CorpNet has been honored in the regional awards. With a healthy 244% 2-year growth, CorpNet made a significant move from position 213 to 75. CorpNet's Inc. profile can be found at https://www.inc.com/profile/netcom. “I am beyond proud of the exponential growth our company, CorpNet, has achieved in the last year which has helped us secure a spot on the coveted Inc.5000 Pacific Regionals list in 2023. We...

Do I Need an LLC to Freelance?

Do freelancers need an LLC? That’s a question many solo professionals ask as they start and grow their small businesses. While freelancers aren’t legally obligated to form a Limited Liability Company, doing so offers some advantages over operating as a Sole Proprietorship. In this article, I’ll touch on the difference between running a freelance business as a Sole Proprietorship vs. an LLC. I’ll also summarize what’s involved in creating a Limited Liability Company and answer some frequently asked questions about operating as a freelance LLC. Sole Proprietorship vs. LLC Most freelancers...

S Corporation vs. LLC

Limited liability companies (LLCs) and S Corporations are business structures that provide liability protection for business owners and allow for pass-through tax treatment. While they have those things (and some others) in common, they differ in several ways, too. If you’re starting a business or considering changing a sole proprietorship or general partnership to an S Corporation or LLC, it’s critical to understand the similarities and differences. Every business and business owner’s needs are unique in some respects, so I encourage entrepreneurs to do research on their own and enlist...

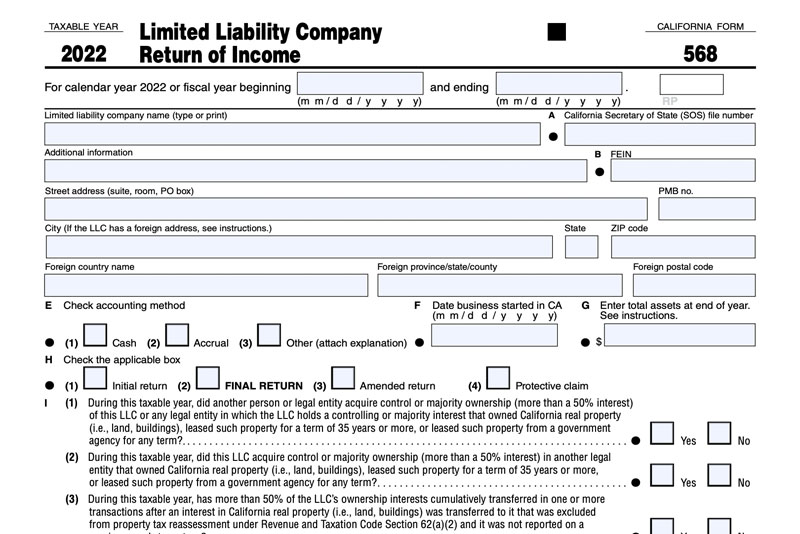

Which California Businesses Must File Form 568?

If you’ve decided to structure your business as a Limited Liability Company (LLC) and plan to register your company in California, it’s crucial to know how to keep your company in good standing by following the state’s compliance regulations. One regulation particularly important to California LLCs concerns their tax filing requirements. What is Form 568? Most LLCs doing business in California must file Form CA Form 568 (Limited Liability Company Return of Income), Form FTB 3522 (LLC Tax Voucher), and pay an annual franchise tax of $800. These businesses are classified as a disregarded...

What Happens When an LLC Owner or Member Dies?

Since a Limited Liability Company (LLC) can have one owner or an unlimited number of members, it’s not uncommon for an LLC to experience the death of one of its members. When that occurs, what happens to the ownership of the LLC? First, let’s define some important terms: Probate occurs when someone dies, and their assets are distributed to pay their liabilities and beneficiaries. Stated another way, probate is a court-led, legal process that begins after someone passes away. The court will distribute their estate to the proper heirs. An executor is someone assigned to follow the deceased...

Can You Change an LLC Name?

The decision to change an LLC name is one not to consider lightly. After all, your business name is one of your most important brand assets. But sometimes, a name change is in order for one of many reasons. Perhaps there was a mistake in your formation paperwork, so you need to correct the name. Or perhaps the name was fine in the past, but now it's not because it includes the name of a business partner who just retired. Or maybe your business has expanded into other products or services, and the name no longer accurately reflects what you do. Another reason you might consider changing...

How to Hire a Ghostwriter for Your Accounting Blog

Does your accounting business need a blog? The answer is yes! Website content like service pages and blog posts help your business rise in the search engine rankings and this means more people will find your website and inquiry about your service offering. So, if your business website doesn’t have a blog, it’s time to create one. If you already have a blog, are you keeping it current? When potential clients see a website with an outdated blog, it immediately gives them cause for concern. But, you may be thinking, you’re so busy running your accounting business, you don’t have the time to...

How to Start a Tutoring Business

Wondering how to start a tutoring business? This step-by-step guide will help you through the planning and launch process.

Does Your Business Need a Sales Tax License?

Does your business need to collect sales tax and remit it to the state or local tax authority? And if it does, how do you go about getting a sales tax license? Moreover, what if your business is selling your products across state lines? Do you need to charge and remit sales tax in those states, too? These are all valid and important questions! We're going to delve into them in this article to give you some helpful food for thought as you research what requirements apply to your business. Please keep in mind that all I share here is for discussion purposes. For professional tax guidance,...

How to Start a Dropshipping Business

It's estimated that a third or more of e-commerce brands use dropshipping as a way to provide products to customers. If you've been thinking about starting an online store but don't want to deal with the costs and hassle of maintaining inventory, you may find the dropshipping business model a viable approach. Ready to learn more about dropshipping as a way to fulfill customer orders? Let’s talk about what it is, some points to consider about the business model, and how to start a dropshipping business. What is Dropshipping? Dropshipping is an order fulfillment approach that enables...

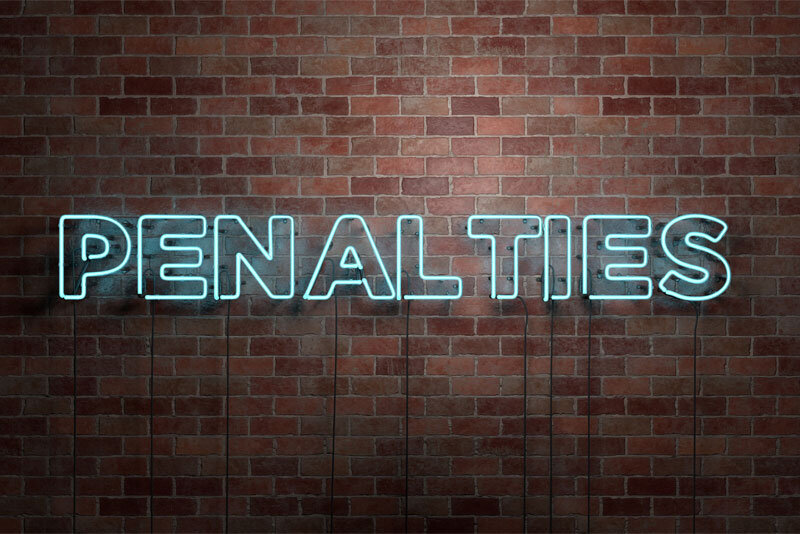

The Consequences of Noncompliance in Business

Business compliance is a phrase that makes many an entrepreneur cringe. But despite the lack of affection for those two words, business owners must take them seriously. The possible consequences for noncompliance range from mild inconvenience to devastating disaster. Most critical is that noncompliance by Limited Liability Companies and Corporations can lead to piercing the corporate veil, which puts business owners’ personal assets at risk. Before I get into the penalties for noncompliance, let’s first take a moment to discuss what it is exactly. What is Noncompliance in Business? Nearly...

How to Start a Business as a Kid or Teen

Starting a business as a kid or teen is exciting! With it, comes an opportunity to learn life-long skills that will help you become a successful adult. And, of course, there's the money you can earn! But how do you start a business as a kid or teen? Well, regardless of your age, you will need to follow pretty much the same business-related rules as when starting a business as an adult. Your parent or guardian will be one of the most important resources in your journey. While you’re their dependant in their household, you’ll want to involve them in the process so that you can get your...

How to Start a Virtual Bookkeeping Business

Wondering how to start a virtual bookkeeping business? This article shares what aspiring self-employed bookkeepers need to think about.

How to Start a Trucking Business

If you’ve always wanted to start a trucking business, now could be the perfect time to put your plan into action. The trucking industry has had an immense impact on the U.S. economy. According to American Trucking Association, 71% of the freight tonnage moved in the United States goes on trucks. So how do you become part of this booming industry? Whether you’ve been a driver for another company and want to begin as an owner-operator, this article will offer insights that can help you work toward achieving your goals. Determine Staffing Needs There are a couple of different ways to begin...