The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

Your Complete Starting a Business in California Checklist

Ready, set, launch! Here’s your starting a business in California checklist. This handy guide will help make sure you don’t miss a thing.

How Do LLC Owners Get Paid?

As a small business owner, how you pay yourself depends on your business’s legal structure and how you elect to pay taxes. The Limited Liability Company (LLC) is a popular legal entity offering liability protection to its owners (called members), simple compliance requirements, and tax flexibility. In fact, tax flexibility is one of the reasons the LLC is such an appealing option for small business owners. Should an LLC Owner Be on the Payroll? If you’re thinking about starting an LLC, you have several options for how you want to organize your company regarding paying taxes. Whether or...

What Is the LLC Tax Rate?

Before forming an LLC, many entrepreneurs ask about the standard LLC tax rate to see if this form of entity is a solid option for their new business. This is an excellent question and one that can be best answered by exploring what an LLC is and how it is taxed. The LLC (limited liability company) business entity type is one of the most popular selected by small business owners. It shields the owner’s personal assets from the liabilities of the business and may result in some tax savings to boot. The LLC is an entity formed according to state statute, and it has flexibility in how income...

How to Revoke an S Corp Election

Many limited liability companies (LLCs) and C Corporations choose to be taxed as S Corporations to lower their tax burden. It’s relatively easy to do as long as the business entity meets IRS requirements and files Form 2553. But what happens if a business owner finds an S Corp hasn’t worked to their advantage? Or perhaps, their situation has evolved, and S Corp status no longer benefits them. Fortunately, in either case, companies can revoke an S Corp election and change back to their original LLC or C Corp tax status. To do so, they must follow the IRS’s instructions and take care of...

Is an LLC a Corporation?

Many entrepreneurs wonder if an LLC is a corporation. An LLC is not the same thing as a corporation, but it's easy to get the two business entity types confused. In this article, I’ll explain the difference and highlight some of the advantages these structures have over unregistered entities. Limited Liability Companies and corporations are both types of statutory (state-registered) entities. To create them, business owners must file formation paperwork with the state and pay a registration fee. There may be other tasks as well that state law requires to legally form an LLC or establish a...

What Business Owners Need to Know About Filing Taxes in 2022

Tax season is right around the corner. A lot has changed, tax-wise, in the past year due to new legislation. Here’s a quick look at what business owners need to know about filing their taxes in 2022. Sole Proprietorship Sole proprietors are unincorporated businesses with no distinction between the business owner and the business. The business owner is responsible for all the business’s debts, losses, and liabilities. Business earnings are considered personal income, and at tax time, they need to file a Schedule C (IRS Form 1040) “Profit or Loss From Business.” The filing deadline for this...

Stats, Tips, and Steps for Starting a Freelancing Business

If you have marketable skills and knowledge as a self-employed independent contractor, you may wonder if you should freelance, and if so, how you'd go about starting a freelance business. And with the current economic climate of the great resignation and possible recession, freelancing could be a viable option for ensuring financial stability. And an even greater advantage to freelancing is that it brings a lot of benefits that include the flexibility to choose the type of work you do, the ability to decide who you work with, adjustable hours and the ability to set your own schedule,...

Your Guide to Starting a Business in Delaware

Thinking about starting a business in Delaware and wondering what you need to do? This 17-step guide will give you valuable insight.

14 Steps for Starting a Business in Nevada

You have a phenomenal business idea, you’ve done some homework to verify your idea is viable, and now you’re ready to take the necessary steps to make your dream of starting a business in Nevada come true. Starting a business in Nevada offers the opportunity to take charge of your own professional destiny in a state known for entrepreneurial innovation and success. Entrepreneurs find Nevada an attractive state to launch a business for many reasons, including: Accessibility to the West Coast and California markets No state corporate or individual income tax No state franchise tax Financial...

What is a Statutory Close Corporation?

A Statutory Close Corporation (also known as “Close Corporation”) is a corporation that does not publicly trade stock and is formed under a special statute. This type of corporation is held by a limited number of shareholders. In some states, Close Corporations may have up to 50 shareholders, in others they must have fewer. Shareholders may run their corporation directly without oversight by a formal board of directors or the obligation to hold shareholder meetings, provided they have a shareholders’ agreement in place that eliminates those formalities. Not all states recognize the Close...

10 Mistakes to Avoid When It Comes to the CARES Act Funding Relief

With tons of misinformation swirling out there, you may be afraid of making a crucial mistake when it comes to applying for and receiving CARES Act relief funding. Here are 10 mistakes to avoid. Application Mistakes 1. Not Being Prepared Any delay in your application could mean your business gets bumped to the bottom of the list. Have on hand: Basic business and contact information Average monthly payroll costs including employee salaries, wages, and commissions; payment of cash tips; payment of vacation; parental, family, medical or sick leave, insurance premiums, etc. 2019 Tax Forms...

How to Get Certified as a Women or Minority-Owned Small Business

Small business certification comes in many forms and offers incredible opportunities for business owners to work with and compete with larger businesses for contracts. Federal government agencies and many state and local governments must set aside a percentage of their contracts to small businesses, including women-owned and minority-owned businesses. In today's article, I'll review how you can get certified as a woman or minority-owned small business. How Do I Get Certified as a Woman-Owned Business? There are two types of women-owned business certifications: Women’s Business Enterprise...

Checklist for a Home-Based Business

Many entrepreneurs start their small businesses in their homes. Without the costs associated with renting or buying office space, it helps keep startup expenses down. Still, business owners running their companies out of their houses must pay attention to many details to position themselves for success. Besides getting office supplies, technology tools, and other necessities, they must make sure they take care of the legal requirements for operating their businesses. Every new company’s needs are unique in some ways, so it’s helpful to talk with an attorney and tax advisor for...

7 Tips to Help Your Business Survive Through a Recession

Is there a recession on the way? The best and most honest answer is maybe. Some economic signs point to a coming economic downturn, while others, like the nation operating at nearly full employment, suggest otherwise. It may be a cliché, but only time will tell. In the meantime, savvy small business owners should change some of their habits and activities now, so these new behaviors are startling if a recession hits. We explained how to best prepare for a recession, so first, make sure your small business has enacted what you prepped for. Here are some tips for surviving a recession. Is...

How to Start a Business With a Partner

You’ve heard the phrase "two heads are better than one” and that often rings true for entrepreneurs. Along with the pooled knowledge from multiple brains, having a business partner brings the perks of additional funds, a wider breadth of skills, a built-in support system, and another set of hands to handle tasks. I know a thing or two about all that because I started CorpNet with my business partner and husband, Phil. While not all business partnerships involve spouses, many of the same considerations come into play when contemplating how to start a business with a partner. A Few Things...

How to Start a Tax Preparation Business From Home

Do you already have experience in preparing tax returns as an employee or temp for a tax agency and wish you had more control over your schedule? Or are you looking to capitalize on your math abilities and attention to detail on your own terms? Either way, you may be wondering how to start a tax preparation business from home and if this decision is right for you and your lifestyle. With the complexity and ever-changing nature of the U.S. tax code, I don’t believe it’s a stretch to say that demand will always exist for professional tax preparers. They serve an essential need. Operating an...

What is the Owner of an LLC Called?

The Limited Liability Company (LLC) business structure is a popular choice for entrepreneurs in nearly all industries because of its simplicity, personal liability protection, and tax and management flexibility. An owner of an LLC is called a member, and an LLC may have one or more members. What LLC members call themselves — i.e., titles for LLC owners — depends on their individual preferences and what is most appropriate for their involvement in operating the business. No specific rules exist for what LLC members may call themselves. Considerations When Choosing Titles In some LLCs, the...

5 Ways to Lower Your Risk When Starting a Business

It’s important to understand when starting a business: there is no 100% guaranteed way to eliminate the risk that entrepreneurship brings. You can’t be sure your customers will pay you on time. Your employees can quit without notice. Your vendors might deliver damaged products. All of these, among other risks, make it difficult for you to know what’s going to happen tomorrow, much less next year.

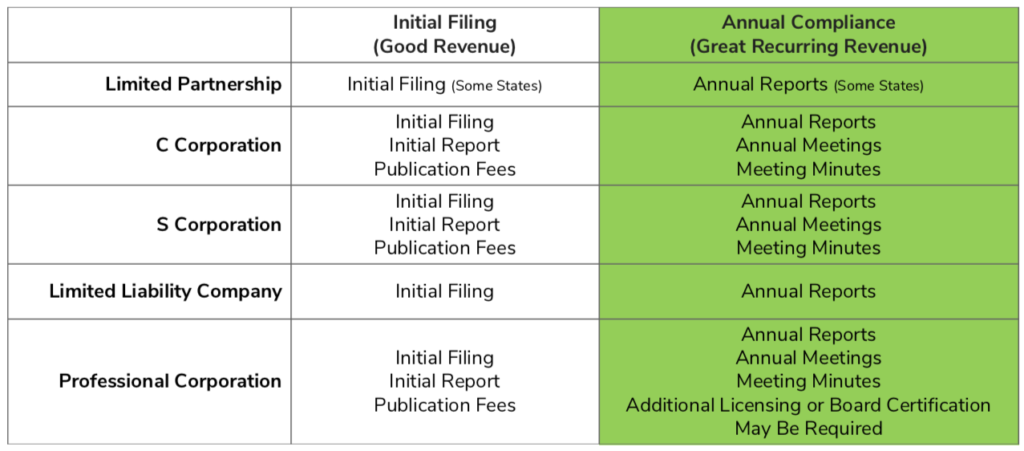

How CorpNet’s Partner Program Helps Professionals Increase Revenue Without Adding Overhead

CorpNet has always been focused on helping entrepreneurs in all industries succeed. We not only offer services to help them save time and money in forming their own businesses, but we also provide a program for accountants, attorneys, and other professionals to enable them to expand their client services and increase revenue. I recently presented two webinars about the CorpNet Partner Program: Increase Revenue & Client Satisfaction Without Increasing Overhead or Staff – Which explains the Partner Program and how it enables accountants to expand their services quickly and with minimal...

5 Steps to Start a Business By Year End

What do you need to do to get your startup off the ground before next year? These steps to start a business will give you the direction you need.

Outsourcing to Get Back to Business

Making plans to get your business back on track post-coronavirus pandemic? Here are five responsibilities you should consider outsourcing so you can devote more of your time and energy to the areas where you are most needed. 1. Website Updates and Maintenance Your website is likely the most important marketing tool in your arsenal and yet it also probably gets neglected from time to time—especially in the aftermath of a crisis, such as a coronavirus. Unless you’re into coding and application updates, outsourcing IT tasks such as website fixes is a great place to start delegating. Think of...

How To Safely Reopen Your Small Business to the Public

As the country makes plans to reopen restaurants, retail, public buildings, and schools, your topmost concern should be the safety and well-being of workers and customers alike. Your reopened business will be scrutinized and the measures you take to reopen safely will go a long way in how your clients and customers feel about supporting your company post-pandemic. The risks are still real so it’s important to be scrupulous in formulating your reopening plan and how you execute it. Below are a few tips and suggestions to help you safely reopen your small business to the public. Three Key...

Time to Declare Your Independence

For many, the American dream is all about entrepreneurship. Business ownership is a way to declare personal independence and even though the economy has been a roller coaster lately, it hasn’t quieted America’s entrepreneurial spirit. As a matter of fact, despite the current level of economic uncertainty, the number of EIN applications shows it hasn't slowed new businesses from starting. But startups are not where all the entrepreneurial action is. Current business owners have been busy, trying to keep their businesses running at all costs. Whether you’re a startup entrepreneur or a...

10 Ways to Create a Successful Brand for Your Small Business

One of the key steps to starting a new company is creating a strong brand. Do it right, and you’ll have a memorable brand that customers line up to do business with. If you are a new business owner, you might not know where to even start. I've been there and I totally understand that feeling. Today I'd like to share ten steps to help you create a great brand for your small business. 1. Understand the basics of a small business brand To craft your brand message, start by asking yourself (and answering) these questions: What does your company do? Can you distill that down to a few...

The Startup Business Plan: Why It’s Important and How You Can Create One

I think it’s safe to say that nearly all business experts agree that all entrepreneurs can benefit from having a business plan. Why is a business plan important for your startup? According to a study by Palo Alto Software, entrepreneurs who have a business plan are about twice as likely to successfully grow their business, attract investors, and get loans than those who did not have one. What is it about a business plan that makes it such an essential ingredient for success? Let’s take a closer look! Why a Business Plan Is So Important We’ve all read the stories of million-dollar...

What are Articles of Incorporation?

If you’ve decided to establish your business as a corporation, you’ll need to fulfill your state’s requirements for registering your company. Among those requirements is filing an Articles of Incorporation (sometimes called Certificate of Incorporation) with the state government. Articles of Incorporation is a legal document containing important information about the company, and it must be approved by the Secretary of State office. Why Articles of Incorporation are Important Filing Articles of Incorporation registers the company as a C Corporation with the state. It makes the business a...

Did You Overlook Trademarking Your Brand?

You probably didn’t come up with the perfect business or product name overnight. Most likely, you brainstormed. You sought the advice of colleagues and friends. You tested out a few options, and checked what domain names were available. In short, you’ve invested a lot of time to create and build the brand. How well are you protecting this valuable asset? Do you know if you’re legally allowed to use the name you picked, and what will prevent someone else from using the same name? Whether you just launched a business, have been running one for years, or are considering starting a new...

Back To Basics: The Difference Between Copyright and Trademark

As the kids are back to school and studying new things, it’s also a wonderful time to revisit some basic elements of business. Whether you’re starting a business or are already running your company, knowing the difference between a copyright and a trademark is one of the fundamental “must knows” every entrepreneur should understand. So, what is the difference between a copyright and a trademark? Let the learning begin! Copyright A Copyright protects works you’ve created, such as research, photos, blog posts, books, articles, music, art, website content, computer code, and other forms of...

Trademark vs. Service Mark

Trademark vs. service mark? What's the difference? Both are issued by the United States Patent and Trademark Office to distinguish a brand's products and services from those of other businesses. Trademarks distinguish a company's products, whereas a service mark relates to the services a company provides. Both fall under the category of intellectual property. Why Apply for a Trademark or Service Mark? When you're building a brand, it's important to differentiate yourself from your competition. Moreover, the last thing you want is for another company to hijack your company name or logo and...

What Does It Mean to Have Multiple Trademark Owners?

One of the many risks business owners face is one that rarely comes to mind—but could put your business in a dangerous position. We’re talking about trademark protection for your intellectual property. A trademark is a word, phrase, name, or symbol that identifies the source of a product or service and distinguishes it from competitors. You can trademark your company name, product names, logos, and taglines. Running a Business Without Trademark Protection Without the protection of a federally registered trademark: Your company or product name could be stolen. Without trademark ownership,...