The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

Do I Really Need an LLC or Can I Remain a Sole Proprietor?

If you’ve been operating as a Sole Proprietor and are wondering if you should register your business with the state and form a Limited Liability Company (LLC), the answer is a "yes.” Although Sole Proprietorships are the most common type of business entity in the United States, they come with significant risk for owners. That’s because a Sole Proprietorship is not a separate entity from its owner – there’s no legal distinction between the two. If a Sole Proprietorship is sued or can’t pay its debts, the personal assets of the owner are at stake. An LLC, on the other hand, is registered...

Twelve Federal and State 2026 Tax Planning Moves for Business Owners, Advisors, and CPAs

Signed into law on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) (Public Law 119-21) includes wide-ranging tax changes that may call for some significant adjustments in how you plan for taxes in 2026. In particular, the bill reshapes State and Local Taxes (SALT) deductions, the standard deduction, and new write-off allowances for some expenses. Whether you’re a business owner managing growth and compliance or an advisor/CPA guiding clients through multi‑state complexity, these are the 12 highest‑impact moves we’re seeing for 2026. A Quick Baselines to Anchor Your Projections...

Can You Run a Business Without a Registered Agent?

Whether you may operate a business without a registered agent depends on your company’s business structure. Formally registered business entities (such as Limited Liability Companies and Corporations) must designate a registered agent on their formation documents and maintain registered agent services on an ongoing basis. Sole Proprietorships (and General Partnerships that have not converted to an LLP or another form of Partnership) are not required to have a registered agent because they do not file formation paperwork with the state and are not considered separate legal entities from...

Do I Need an EIN For a DBA?

A DBA, also referred to as Doing Business As, a fictitious name, or a trade name, is a name a business uses that’s different from the legal name of the company. It’s common for an individual who wants to start a business as a Sole Proprietor to register a DBA instead of using their legal name as the business name. Doing so protects the privacy of the Sole Proprietor and creates a degree of professionalism for the business. A Limited Liability Company (LLC) or a C Corporation might be registered with the state as one name but operate under a DBA that better describes its product or service...

Can You Register an LLC Without a Social Security Number?

People often assume they will need a Social Security Number (SSN) to register an LLC with the state, but that is not necessarily true. There are identification requirements when registering a business, but an SSN is not always required. Every state has laws pertaining to opening a business, so it’s important to check what your state requires. In most cases, however, you can register an LLC without an SSN. The Role of a Social Security Number The SSN was introduced in 1936 as a means of tracking income and providing retirement and disability benefits. All SSNs are issued by the Social...

Is an LLC Incorporated?

As I’ve worked with entrepreneurs over the years, I’ve found that a particular point of confusion centers around whether a Limited Liability Company (LLC) is incorporated. Those looking to start a business often are confused about what it means to be incorporated and the differences between an LLC and a Corporation, which is a type of business entity that is incorporated. An LLC is not incorporated and it’s not the same thing as a Corporation. Having said that, however, there are similarities between LLCs and Corporations. You’ll read more about LLCs and Corporations and how they operate,...

Payroll Taxes 101

Whether you’re a Sole Proprietor with only a handful of workers or a corporation with hundreds of employees, you are responsible for collecting and paying employment taxes to federal and state tax agencies. However, while federal payroll taxes are the same no matter where your business is located, state and local payroll taxes differ according to the jurisdiction’s laws and tax codes. Payroll taxes can be confusing and overwhelming to new business owners. In today’s article, I’ll break down the types of payroll taxes to help you understand what they are and what you need to consider....

How to Convert an LLC to a Nonprofit

If you’ve been operating a business as a Limited Liability Company (LLC) and you’re thinking about converting to a nonprofit, there are certain steps you’ll need to take to accomplish that. It varies depending on your state, but in many cases, you won’t be allowed to directly convert an LLC to a nonprofit. Instead, you’ll need to follow the rules of your state to dissolve the LLC and then start a new nonprofit organization. Some states, however, do permit a conversion, so I’ll tell you about that process, as well. Before we take a deeper dive into changing your LLC to a nonprofit...

How to Track Your Accounting Firm Clients’ Entity Compliance Deadlines with Streamlined Systems and Workflows

Accounting firms’ clients often need help staying current with their ongoing small business compliance requirements. With states imposing different renewal schedules, filing due dates, and change-management rules, it’s challenging to track upcoming tasks and deadlines. And for clients with entities in multiple states, things become especially difficult. This opens an ideal revenue opportunity for accounting firms. By expanding their client advisory services to include compliance monitoring and filing services (such as annual reports, business license renewals, foreign qualifications, and...

The 2026 S Corporation Election Deadline Is Right Around the Corner

The S Corporation election deadline for LLCs and C Corporations is March 16, 2026. So, if you’re considering changing your limited liability company or C Corporation tax treatment from its default status to an S Corporation, time is of the essence! To be considered an S Corporation for tax purposes in 2026, existing LLCs and C Corporations must file their election within two months and 15 days (within 75 days total) after the start of their 2026 tax year. For example, a company with a tax year that began on January 1, 2026, must file IRS form 2553 no later than March 16, 2026....

Become Indispensable: Add Compliance Monitoring to Your Client Advisory Services

If you’re an accountant, bookkeeper, business coach, consultant, or other professional service provider, you may be facing the daunting challenge of securing client loyalty and trying to grow revenue without increasing your workload or adding substantial overhead to your bottom line. While hiring employees or using subcontractors can allow you to take on more work, that can add significant costs to your bottom line. Instead, consider expanding your client advisory services by adding compliance monitoring and business entity filing. Compliance Monitoring as a Value-Add Service Clients...

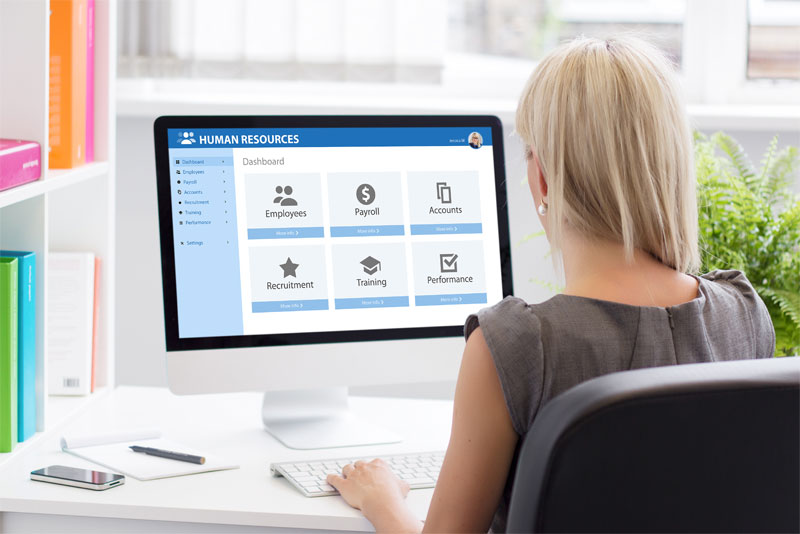

Setting Up Payroll for an LLC or Corporation

Payroll involves far more than just cutting a paycheck to employees. It entails calculating work hours, wages, salaries, benefits, wage garnishments, and withholding and paying employment-related taxes. So, what do business owners need to know about setting up payroll for an LLC or corporation? In today’s post, we’ll cover all of this and more. Seven Key Steps for Getting Started The account registrations needed, steps necessary, and forms required to set up and administer payroll are similar regardless of the business entity type. My recent article, What Is Payroll? offers detailed...

Common Mistakes to Avoid When Choosing and Registering a Business Entity

Oversights, errors, and a lack of follow-through during the business entity selection and registration process can have dire consequences for entrepreneurs. With extra costs, legal issues, and stunted growth potential among the possible side effects, it’s important that business owners know what pitfalls to watch out for and how to avoid them. Below are some of the most common mistakes new entrepreneurs make when forming their new business. 1. Choosing an Entity Type Without Considering a Tax Strategy New business owners are often drawn to the Limited Liability Company (LLC) structure...

How to Remove a Member from an LLC

Like most entities, businesses evolve and change over time. Changes in ownership can be part of that evolution, as an LLC member could decide to move on to another venture, pass away, or reach a point where they are no longer a good fit for the company. A member who desires to leave an LLC normally can do so without much trouble, especially if terms for voluntary withdrawal are sufficiently covered in the LLC’s Articles of Organization and/or Operating Agreement and all other members agree to the terms. When other owners want to remove a member who doesn’t want to leave, however, the...

How to Start Your Own Business

The U.S. Chamber of Commerce reports that more than 5.5 million new business applications were filed in the United States in 2023. This record number has continued to grow since the surged started in 2020. If you’re one of the millions of Americans with a dream of starting your own business, I’m happy you to say you're in good company. As someone who has formed a number of small businesses, I’d like to provide some advice and walk you through the steps of getting started. Opening your own company, whether it’s a Sole Proprietorship, Partnership, Limited Liability Company (LLC), or C...

How to Register a Business Name

Choosing and registering a name for your business is a big deal, as the name will help to identify your brand and set your company apart from others. There are some legal considerations to think about, however, so let me walk you through the process I recommend for selecting a business name and getting it registered. An important note is that not all businesses need to register a name. If your business is set up as a Sole Proprietorship or General Partnership using the owners’ legal names, you don’t need to register the business at all. If you plan to operate a Limited Liability Company...

Can an S Corporation Use LLC or Inc in Its Business Name?

If you are considering electing S Corporation status you might wonder how this will impact your existing LLC or C Corporation. One question that comes to mind quickly is the continued ability to use LLC or Inc with a business name. S Corporation election is a tax classification, it does not change a business’s legal structure. Limited Liability Companies and C Corporations that elect S Corporation status remain the same underlying business entity and retain their legal business name. Therefore, a Limited Liability Company may use "LLC" (or another limited liability company designator...

How Do I Legally Protect My Side Hustle?

Nearly 7 in 10 Americans now have a side hustle. Whether you're freelancing, selling products online, offering consulting services, or driving for a rideshare company, that extra income stream represents more than just pocket money. For many people, it becomes a business. A job on the side might help cover necessary expenses or provide some extra fun money, but there are some financial and legal implications you’ll need to consider if you’re thinking of getting started or already working in one. Legal obligations concerning side work must be taken seriously, as there can be serious...

Sole Proprietorship vs. LLC

Every year, millions of Americans start businesses. And every year, most of them make the same mistake: they operate as Sole Proprietors by default, never realizing what they're risking or missing out on. The decision between operating as a Sole Proprietorship versus forming an LLC is one of the most important choices you'll make as a business owner. Yet it's also one of the most misunderstood. Five myths first-time entrepreneurs believe: I don't need an LLC until I'm making real money. The reality is liability risk exists from day one, regardless of revenue. A single lawsuit could wipe...

What Is a Reseller License?

A reseller license certifies a company doesn't have to pay sales tax when buying products on a wholesale basis for the purpose of reselling them to customers. In this scenario, the final sale customer pays sales tax when they purchase those products from the reseller, which prevents a double taxation from occurring. Important nuances to know about reseller permits and licenses: In some states, a reseller license might alternately be called a reseller permit, resale license, resale certificate, sales tax exemption certificate, or some other term. Sales tax laws vary by state, and each...

Should I Be My Own Registered Agent?

The owner of a Limited Liability Company (LLC) or Corporation might consider being their own registered agent since it eliminates the cost of contracting another party to accept service of process and other official notifications on the business’s behalf. However, while legally you may be allowed to be your own registered agent, it’s likely not the best option. Why? Let’s talk about a registered agent’s responsibilities and the valid reasons for entrusting those duties to a commercial registered agent rather than taking them on yourself. What Does a Registered Agent Do? A registered agent...

Compliance Errors and Oversights that Could Close Your Small Business

Every small business is expected to remain in compliance with all applicable laws, regulations, and standards. Not doing so can be highly detrimental to your business, resulting in penalties and costly fines, damaged reputation, disrupted business performance, business closure, and in extreme cases, criminal charges. Penalties for not remaining in compliance depend on the state in which your business is located, what rules were violated, whether the violation was a one-time or repeated event, and other factors. Neglecting to adhere to rules such as filing reports, holding required...

What Are Articles of Incorporation?

If you’ve decided to establish your business as a corporation, you’ll need to fulfill your state’s requirements for registering your company. Among those requirements is filing an Articles of Incorporation (sometimes called Certificate of Incorporation) with the state government. Articles of Incorporation is a legal document containing important information about the company, and it must be approved by the Secretary of State office. Why Articles of Incorporation are Important Filing Articles of Incorporation registers the company as a C Corporation with the state. It makes the business a...

Maintain Business Compliance to End the Year in Good Standing

As we move into the fall and winter months it's time to begin thinking of year-end compliance responsibilities and business activities. We'd like to help you prepare for the year-end and we want to help you get all your legal ducks in a row. To assist in these efforts, we’ve put together a year-end compliance checklist to set you on the right path. And to make the entire year-end compliance process as easy as possible, we've also created an annual compliance checklist you can download in a PDF (see below). File Your Annual Corporate Documentation Most states require registered C...

Checklist for a Starting a Home-Based Business

Many entrepreneurs start their small businesses in their homes. The process can be feel overwhelming, but it doesn't have to be. The following checklist provides a list of considerations for starting a home-based business. While not every business will need everything on this list, it is a great starting place for future business owners. 1. Home Office Furnishings and Equipment Every home business needs to be well-equipped to handle its day-in-day-out administrative tasks. It can be helpful to have a dedicated space within your house where you won’t be interrupted and where you’ll have...

Annual Report List by State for LLCs and Corporations

Many state governments require LLCs, Corporations, and other registered business entities to file annual reports each year. And some Secretary of State (or comparable agency) offices may require these types of reports to be filed according to different timeframes (e.g., biennial and decennial reports). Figuring out the reports they must file and the deadlines they must meet can become frustrating for busy small business owners. Ferreting out states’ specific requirements can prove a daunting task—especially with so many other tasks to juggle when starting and growing a company. Who has...

Fall Tips To Help Your Business Have A Strong End-Of-Year Finish

Although most of the year has already passed and we’re now into the autumn season, don’t panic if your business has fallen a little bit behind on its goals. It’s not too late to make changes that can help lead to a strong finish in 2025. Whether you’ve just started your business or have been running yours for years, the key is to take action sooner rather than later—and to focus on efforts that will improve your bottom line now and into 2026. Nurture Customer Relationships If you’ve fallen out of touch with some customers, now’s the time to reconnect. Just be careful to do so with their...

CorpNet Named LA Times Studios Fastest-Growing Private Companies

CorpNet has been named one of Los Angeles' Fastest Growing Companies by LA Times Studios. Each year, LA Times Studios presents the 30 fastest growing private companies headquartered in Los Angeles County. Firms are ranked by two-year revenue growth from 2022-2024. Revenue figures were submitted along with verification documents. To qualify, firms must have had a minimum of $100,000 in revenue in 2022 and greater than $3 million in revenue in 2024. Companies must be for profit, privately held and cannot be a division or subsidiary. “I am so honored to have CorpNet.com named to the LA Times...

Do You Need to Renew Your DBA?

Do you know if your DBA needs to be renewed? If so, do you know the date it will expire if you don’t take action? Whether you need to renew your DBA depends on where you live. Rules pertaining to DBAs vary from state to state and among some local governments, so you’ll need to do some research to find out what applies to you. Many states require business owners to renew their DBAs every five years, but some states, counties, and cities have shorter time frames for renewals. Other states offer renewal terms of up to 10 years, while a few states do not require any renewal of DBAs. If you’re...

How to Close an LLC Before Year End

If you’re thinking of closing your LLC before the year ends, you may be feeling overwhelmed. And you are probably wondering what you must do to exit the business without leaving any loose ends behind. Indeed, there is more to shutting down a business than merely ceasing to sell products and services. The exact actions a Limited Liability Company’s members must take depend on where the business is registered, whether it has employees on its payroll, and other factors. It can be tricky to determine all the requirements, so LLC owners (a.k.a. members) should carefully research the things...