The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

Filing an Intent to Use Trademark Application

Choosing the perfect business or brand name is only half the battle when starting a new venture. You need to protect that name from getting stolen or misused. But what if you haven’t started using the brand name yet? The good news is even if your website is still under construction and marketing materials are still at the printers, you can apply for protection with an intent to use trademark application. What is a Trademark? In its most basic definition, a trademark is a word, phrase, symbol, design, or combination of these elements identifying the source of a product or service. A...

Registered Business Name vs. Trademark

One of the first decisions new entrepreneurs make is “What should I name my business?” A lot of brand equity gets built around a business name, so it’s essential to protect that valuable marketing asset. During a presentation to accounting professionals, I discussed trademarks vs. registered business names and the differences in the protection and peace of mind they offer. I believe much of the information I shared may help you, too, as you explore your options for safeguarding your business name. Let's Start With Basic Definitions Business Name - A business name is just that. It’s the...

How to Protect Your Brand with Trademarks

If you’ve incorporated your business or formed a limited liability company, you’ve taken critical first steps toward building a successful business. When registering your business, you’ve protected your company name from being used by competitors in the state the entity was formed. However, your business name remains open to the risk of similar companies in other states claiming the name and potentially other brand assets. Fortunately, you can further protect your brand with trademarks. An Overview of Trademark A trademark is a word, phrase, symbol, or design (or a combination of them)...

Trademarks vs. Copyrights vs. Patents

From your company logo to your trade secrets, your business’s intellectual property has value. That’s why it’s important to take measures to protect it. What are the various types of intellectual property and how can business owners’ safeguard them? Here’s a primer on trademarks vs. copyrights vs. patents. Trademark Basics A trademark is a word, phrase, name, design, or symbol (or a combination of those elements) that identifies the source of a product or service. Its purpose is to distinguish a business and its products or services from competitors. Trademarks can be a company’s name,...

What Is a Trademark?

Now that you’ve started your business, it’s time to protect its name. After all, your business name is — and will continue to be — one of the most crucial branding assets you possess. So, how do entrepreneurs protect that critical element from being infringed upon locally and nationwide? Registering a trademark with the United States Patent and Trademark Office (USPTO) is a wonderful step to accomplish that. By registering for U.S. Federal Trademark protection, trademark owners are eligible for numerous benefits such as treble damages in some cases of infringement, the right to use the ®...

CorpNet Awarded Inc. 5000 for 2022

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. 5000 list in 2022 as one of the fastest-growing private companies in the country. This is the fifth year CorpNet has been honored and 2022 is the highest ranking to date. CorpNet's Inc. profile can be found here. "It is a true honor to have our company, CorpNet.com, named again on the Inc.5000 list! This is huge as our 2022 recognition secures us as our highest rank yet and I am beyond proud of the team behind us making this happen every day. We've all worked together to go above and beyond for our clients, have secured...

What is the Role of an Incorporator?

Starting a new C Corporation can be complicated and entails several legal, administrative, and administrative steps. Whether you’re starting the business on your own, with a partner, as part of a team, or converting your current business structure to a corporation, it’s crucial that you accurately follow the guidelines established for incorporating in your home state. For that reason, some new business owners decide to hire a third party, such as a professional business formation company, for the role of an incorporator. In simplest terms, the role of an incorporator is to prepare and...

What is the Role of an LLC Organizer?

Starting a new Limited Liability Company (LLC) can be complex, entailing several legal, administrative, and organizational steps. Whether you’re starting the business on your own, with a partner, as part of a team, or converting your current business structure to an LLC, it’s vital that you strictly follow the guidelines established for LLCs in your home state. For that reason, some new business owners decide to hire a third party, such as a professional business formation company, for the role of an LLC organizer. In simplest terms, the role of an LLC organizer is to prepare and file all...

Choosing the Best Business Structure for Your Industry

Entrepreneurs face many critical decisions as they launch their businesses. Among the most important is selecting the best business structure for their company. Because of the legal, financial, administrative, and operational implications of the entity chosen, business owners have many factors to consider. For instance, what is the best business structure for their industry and type of business? In this article, we’ll explore some of the things to keep in mind as you select an entity type for your new business. And I’ll offer some insight into which business structures might offer the...

Setting Up LLC Partnership Agreements

The Limited Liability Company (LLC) business structure is one of the most flexible and simple business entity types that entrepreneurs may choose. LLCs aren't usually required by states to have an LLC partnership agreement; however, it's something to consider–especially when an LLC will have multiple owners (a multi-member LLC). What Is an LLC Partnership Agreement? An LLC partnership agreement (also called an LLC Operating Agreement) lays the ground rules for operating a Limited Liability Company and protects the legal rights of its owners (called members). It’s written by the LLC’s...

How to Prepare Your Small Business for a Recession

Is a recession on the way? While some economic experts believe a recession is on the way, others, such as the National Retail Federation (NRF), think that although the economy is slowing, consumers are financially healthy and a recession is unlikely in 2022. And the United States is still at nearly full employment. But the recent Small Business Recovery Report by Kabbage from American Express reveals that 83% of small business owners worry that a recession is indeed looming. However, the good news in the report is that 80% of entrepreneurs are optimistic and they believe their small...

10 Strategies for Growing a Business

Uncertainty is not unfamiliar territory for business owners. However, these past few years have brought a significant amount of ups and downs to entrepreneurs everywhere and in nearly all industries. While some companies focused on their short-term goals, other businesses went all-in on securing long-term growth. Developing sound strategies for growing a business, executing those strategies, and streamlining processes are all part of the equation that makes a tremendous difference, whether in an environment of consistency vs. unpredictability and abundance vs. scarcity. Let’s take a look...

10 Ways to Take Care of Your Kids and Your Business This Summer

School’s out! Chances are your kids are celebrating right now because weeks of summer vacation beckon. But, if you’re starting a business or running a business, and you have school-aged children, you’re likely feeling a little conflicted. Entrepreneurs like me, and probably you, struggle a bit in the summer trying to balance our desire to be great business owners and great parents. While I love (and truthfully look forward to) having my kids at home during the summer months, I confess it’s getting increasingly harder to keep them occupied while I’m hard at work. I know this is a struggle...

Virtual Companies and Nexus: What Small Businesses Need to Know

Over the last two years, many businesses have chosen to go virtual, either temporarily or on a permanent basis. But that decision can impact the business’s nexus status. Companies with remote employees in other states may also need to register for foreign qualification, register for payroll taxes in those states, or they may need to start collecting sales tax from places they never have before. Business Compliance Consequences for Pivoting to a Virtual Company Many businesses have pivoted to a remote working model to keep employees safe and many may continue to do so for the foreseeable...

Setting Up a Corporation – Top FAQs

Happy November! We are excited to bring you another post in our monthly FAQ series! When starting a business, one of the first questions an entrepreneur must ask themselves is, "What entity type should I register?" Here at CorpNet, we are often asked to explain the differences between a C Corporation and an S Corporation, how to file a corporation, and even, "What is a corporation?" Top FAQs for Setting Up a Corporation What is a C Corporation? A C Corporation is a standard corporation. It is considered a separate entity from its owners. This means that the corporation is responsible for...

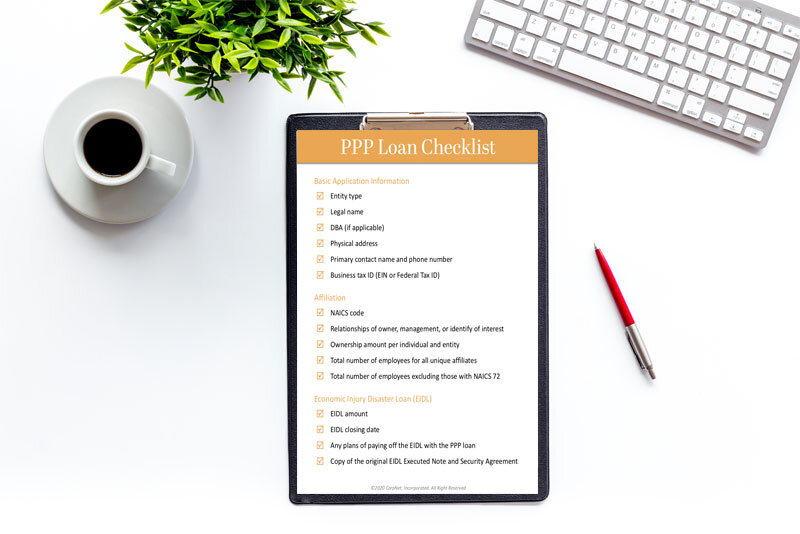

Paycheck Protection Program Loan Checklist

The SBA’s Paycheck Protection Program is an amazing opportunity for small businesses. It provides a 100% forgivable loan to cover payroll, rent, and utilities. The United States government has moved swiftly to get this program funded and operational. And in some cases, a little too quick for the average business owner to keep up with. Small business is the core of CorpNet and our service offering. We’d like to make sure we do everything we can to help business owners obtain PPP loan funds. To do this, we need to make sure you have everything you need to get you Paycheck Protection Program...

What You Should Know About Delaware Annual Reports and Annual Tax

Business entities in the state of Delaware have various reports and filings they must submit to the Delaware Division of Corporations each year. Delaware Limited Liability Companies don’t have to file an annual report, but they do have to file to pay an Annual Tax each year by June 1. Businesses that are registered as a corporation in Delaware must file a Delaware Annual Report every year by March 1, and most must also pay a Franchise Tax fee yearly. These requirements apply whether a Delaware corporation operates in the state of Delaware or somewhere else. In this post, I’ll cover...

Does Being an LLC or Corporation Help Build Business Credit?

Establishing healthy business credit is essential to ensure a company can thrive and grow. If an entrepreneur doesn’t take measures to establish credit in their business name, they may miss out on opportunities and even pay more than they have to for goods and services. Does a company’s business structure matter? Moreover, does being a Limited Liability Company (LLC) or corporation help build business credit? Absolutely! Operating as an LLC, S Corporation, or C Corporation is one of the most effective ways to begin establishing a credit record in the business name. That’s because those...

Meet the Driver and Doer Behind CorpNet: Nellie Akalp, Founder and CEO

Every person on the CorpNet team has contributed to our continued success. Our recently created series of videos features several of our team members to give you a glimpse of “who’s who” and their take on what they do and why they do it. In this post, we’re thrilled to introduce CorpNet Co-Founder Nellie Akalp and the video that features her. Who Is Nellie Akalp? Nellie loves educating and inspiring entrepreneurs and other business professionals. She finds her inspiration to do so through God and her family. Nellie’s husband, Phil, says that Nellie is the most passionate and committed...

Meet the Go-To Person at CorpNet: Milton Turcios, Director of Operations

Every individual at CorpNet brings unique skills and qualities that make them an integral part of our team. This could not be truer of our Director of Operations, Milton Turcios! We’ve recently featured Milton in a video in our series that highlights various CorpNet team members. In this post, we’re introducing you to Milton and the video that shares more about why his co-workers value him so greatly. Who Is Milton Turcios? Like CorpNet’s founder, Nellie Akalp, Milton is the son of immigrants and the first child in his family to be born in the United States. He values the opportunities at...

Meet CorpNet’s Inspiring Senior Account Manager: Amanda Beren

CorpNet’s high-caliber team members, who bring their diverse strengths and talents to work with them every day, fuel our company’s success. No one exemplifies hard work and dedication more than our Senior Account Manager, Amanda Beren. We’ve recently featured Amanda in a video in our series that highlights various CorpNet team members. In this post, you’ll learn more about Amanda and have an opportunity to watch the video that features her. Who Is Amanda Beren? Amanda has worked with CorpNet’s owners, Nellie and Phil Akalp, since our company’s launch — and at the Akalps’ prior business...

Meet the People Behind CorpNet’s Success

We are immensely grateful for our team members’ talents and contributions. They have fueled our growth and remain the key to our continued success in helping aspiring and existing business owners make their entrepreneurial dreams come true. What do our employees love about working at CorpNet? You can see and hear from several of them first-hand in our recent video! Watch now to learn more about how our team-based “like family” work culture empowers and inspires our employees to be the best they can be. We love that they feel valued (because they are!) and appreciate the fun factor that we...

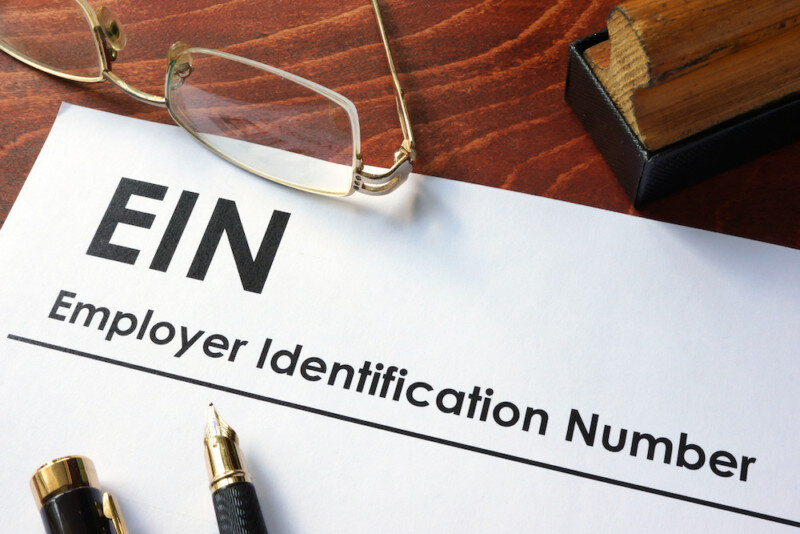

How to Apply for an EIN if You’re Not a United States Citizen

An EIN (Employer Identification Number), also known as Federal Tax ID Number, is a 9-digit number issued by the IRS that the United States federal government uses to identify a business for tax purposes. Every business with employees or registered in the U.S. as a partnership, multi-member LLC (limited liability company), or corporation is required to have an EIN. Foreign companies based in other countries that do business within the U.S. (including e-commerce or as an Amazon seller) must also have EINs to report income and pay taxes. But how do you apply for an EIN if you’re not a United...

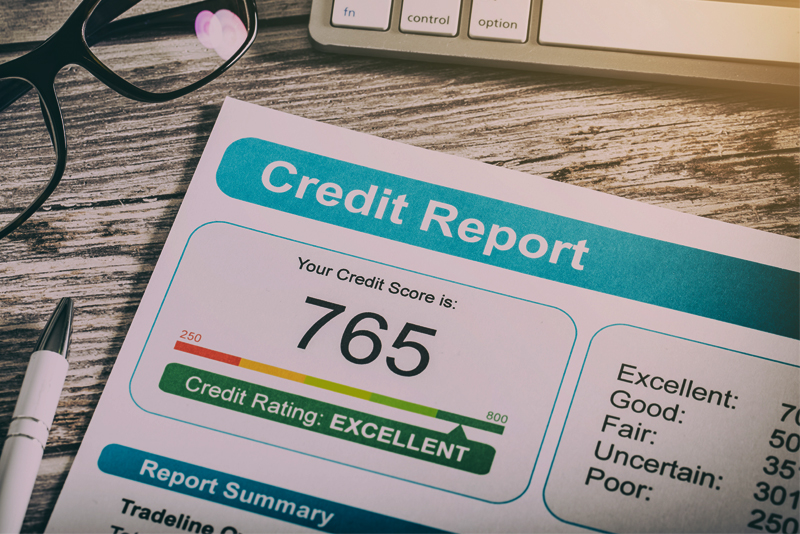

Basic Tips for Building Business Credit

A business entity can have its own business credit record and score. Lenders, suppliers, vendors, and even potential customers might check a company’s credit score (which is publicly available) before providing funding or doing business with the company. Business credit stands as a sign of a company’s financial fitness and how responsible it is in handling its money. A business with a good credit history may benefit in several ways. Increased likelihood of getting funding Lower interest rates on loans Lower insurance premiums More favorable terms and payment arrangements with vendors and...

Understanding the Various Types of Nonprofits

What Is a Nonprofit? A nonprofit organization is created to fulfill a charitable, civic, religious, scientific, literary, or educational goal. Nonprofits do not have private owners, nor do they issue stock or pay dividends to shareholders. Aside from founders or staff being compensated a fair wage for their work in a nonprofit, the organization may not benefit individual stakeholders financially. The United States federal tax code recognizes over 30 types of nonprofits. Some nonprofits are either fully or partially tax-exempt, meaning they do not pay certain taxes. Also, some types of...

Does a Real Estate Agent Need an LLC?

Real estate agents, just like other self-employed professionals and independent contractors, should consider how to safeguard their personal assets from business-related liabilities. As a real estate agent, you may wonder if you need an LLC to get that level of protection. Setting up a registered business entity, like a limited liability company, for a real estate business is an excellent first step toward getting peace of mind. Unlike a sole proprietorship (or partnership), an LLC is a separate legal entity from its owners (a.k.a., “members”). So, if a home seller or buyer files a...

Filing Annual Meeting Minutes Before Year End

Depending on a business’s entity type and the state it’s registered in, its owners may be required to hold annual meetings and record minutes from those meetings. But how do you know if that requirement applies to your company? In this article, I'm going to explain what annual meetings and annual meeting minutes are to help you get on the path to determining if you must fulfill those important business compliance tasks. If you're a professional services provider that coaches or gives direction to business owners, this information may be helpful to your clients, so feel free to share this...

What You Need to Know About Work From Home Tax Deductions

According to Global Workplace Analytics, 25-30% of the workforce will be working from home multiple days a week by the end of 2021. Already a trend before the pandemic, remote working became the “new normal” for businesses of all sizes struggling to stay afloat during safer-at-home directives. Today, both employers and employees have found the positives that remote working offers. However, only employers can claim work from home tax deductions on their income taxes. Let's review who can claim work from home tax deductions, what expenses qualify, and how you should calculation those...

What You Need to Know About the Qualified Business Income Deduction

Tax considerations are a significant factor in how entrepreneurs structure their businesses. The qualified business income deduction (or QBI tax deduction) is an important tax deduction that allows eligible businesses to deduct up to 20% of their qualified business income from their taxes. As a provision of the 2017 Tax Cuts and Jobs Act (TCJA), the QBI deduction was intended to help business owners of companies with pass-through tax elections lower their taxable income and receive additional tax benefits. In today's post, we'll cover all the essential details you need to know about the...

Get Your Office Into the Holiday Spirit

I love the holidays. Celebrating with family and friends is very important to me and my husband, Phil. And we strongly believe in sharing that holiday spirit with our employees and contractors. Unfortunately, last year, like many of you, we couldn’t celebrate in person, but we still made sure our employees knew they were appreciated and valued. This year, we’re back to hosting a holiday party. Our company has employees and freelancers located all over the country, and we’re going to bring them here to Westlake Village to get to know one another and celebrate a great year. While it’s...