The Launch Blog: Expert Advice from the CorpNet Team

Help Clients Choose What Is the Best Business Structure Without Fear of Unauthorized Practice of Law

What is the best business structure? Here's how to help your clients (and boost your revenue) without illegally engaging in the practice of law.

The Advantages and Disadvantages of a Subchapter S Corporation

Before the advent of the S Corporation in 1958, entrepreneurs had two options for forming a business entity. To help encourage small businesses in America, Congress and President Eisenhower created the Subchapter S Corporation. In this post, I’m going to run through some of the S Corporation pros and cons to consider.

Breaking Down Paycheck Withholdings and Deductions for Employees

Ready to hire? Becoming an employer is a big responsibility. One of your primary tasks is to pay and withhold the correct employment taxes, and you’re accountable for explaining that process to your employees. Here’s what you need to know about breaking down paycheck withholdings and deductions for your employees.

How Many LLCs Can You Have?

As an eager and enterprising entrepreneur, you may set your sights on multiple business ventures and wonder if one person can own multiple LLCs. Fortunately, no federal or state limits exist on the number of LLCs someone can own. However, aspiring business owners should know that other factors could prevent them from having ownership interest in multiple LLCs.

Eleven Disadvantages of Choosing a Sole Proprietorship

A Sole Proprietorship is the most popular business structure in the U.S., with nearly three out of four businesses operating as one. But if you’re running a Sole Proprietorship or thinking about starting a business that will operate as one, it’s important that you’re aware of some significant disadvantages to this business model. Let’s start by reviewing the basics of Sole Proprietorships, and then I’ll outline 11 disadvantages that might make you reconsider choosing that entity type for your company. How a Sole Proprietorship Operates A Sole Proprietorship is a simple business structure...

Payroll Taxes 101

Whether you’re a Sole Proprietor with only a handful of workers or a corporation with hundreds of employees, you are responsible for collecting and paying employment taxes to federal and state tax agencies. However, while federal payroll taxes are the same no matter where your business is located, state and local payroll taxes differ according to the jurisdiction’s laws and tax codes. Payroll taxes can be confusing and overwhelming to new business owners. In today’s article, I’ll break down the types of payroll taxes to help you understand what they are and what you need to consider....

S Corporation Election Considerations for Corporations and LLCs

Have you been thinking about whether your business might benefit from being an S Corporation? I presented a webinar for accounting professionals about the S Corp election not too long ago. Within that presentation, I covered information of value to entrepreneurs in all fields. In this article, I will share that insight with you in hopes that it will help you gain a deeper understanding of what it means to be an S Corporation. What Is an S Corporation? The S Corporation is not a business structure in itself. Rather, it is a special federal income tax election option for eligible Limited...

As a Business Owner, Can I Have Multiple LLCs?

Once entrepreneurs taste what it's like to be their own boss and carve their own career path, some decide to pursue starting multiple businesses. Depending on the situation, owning multiple Limited Liability Companies (LLCs) might make sense. Which leads to the question, how many LLCs can someone have? The short answer is there are no particular limits on how many LLCs someone may form, provided they meet all of the eligibility criteria to be an LLC member and comply with all of the federal, state, and local government rules and regulations for operating an LLC. In this article, I’m going...

Tax Registration: What Your Business Needs to Know

Whether you’re a business accountant serving entrepreneurs or you’re a business owner, it’s critical to understand sales and employment tax registration and ongoing requirements. Federal payroll taxes are the same no matter where a business is located, but state employment taxes and sales taxes differ according to tax rates in the various states. I presented a webinar for CPA Academy on this topic, and this blog article will cover what I discussed. So, get ready for a lot of helpful info about various types of employment taxes, payroll tax registration and processing, sales and use tax,...

How to Proactively Manage Small Business Compliance

Besides going through all the proper steps to set up a business, understanding and following through with ongoing compliance requirements is immensely important. I regularly address small business compliance considerations in my writings on the CorpNet blog and webinars that I present to accounting and tax professionals. Compliance is mission-critical to entrepreneurial success, so in today's post, I am sharing a comprehensive list of many of the requirements business owners should be aware of. Realize that business compliance requirements vary depending on where a company is located, the...

Tax Saving Features of Corporations, S Corporations, and LLCs

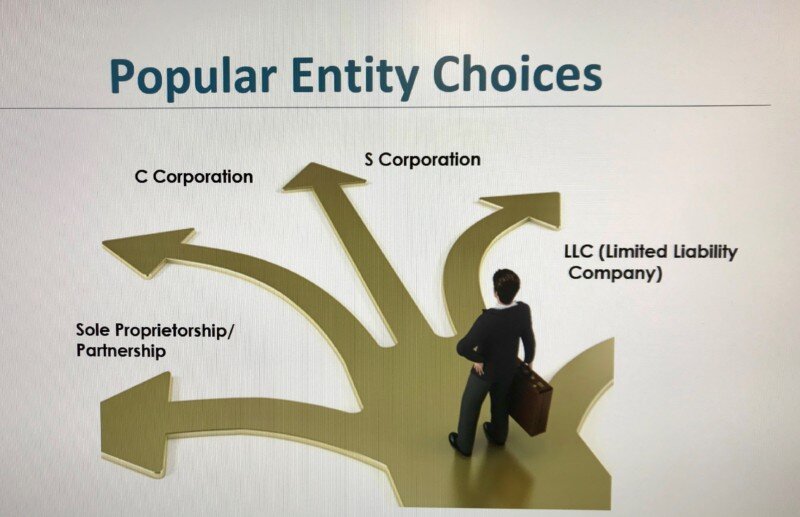

I regularly speak to business owners about entity types and their potential impact from a tax perspective. A while back, I created a webinar for accountants (and other professional services providers that work with businesses) on the topic of business structures and taxes. It is focused on the possible tax advantages and disadvantages of C Corporations, S Corporations, and Limited Liability Companies (LLCs). In this article, I’ll break down the important considerations that I discussed in that presentation. Benefits of Incorporating If you’re operating your business as a sole...

Webinars About How to Choose the Right Business Entity

Wondering how to choose the right business entity? Consider watching these webinars to learn about the pros and cons of various business structures.

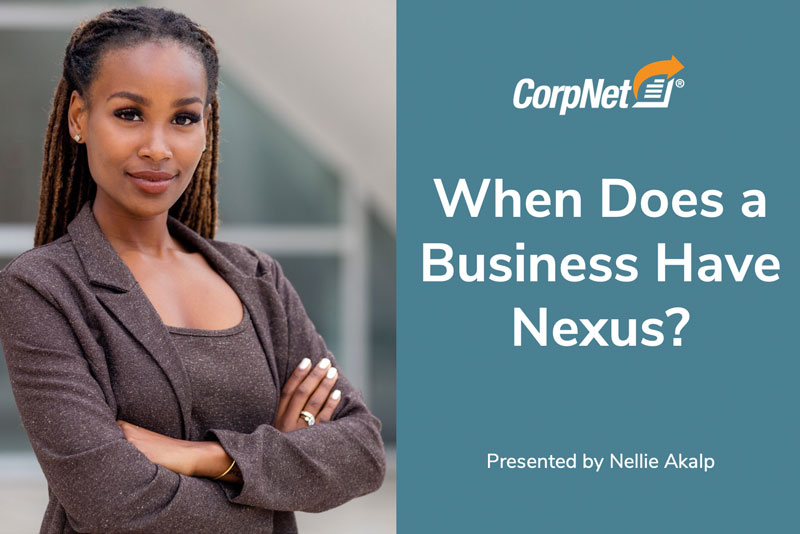

When Do You Have Nexus in a State?

Every business that sells products and services beyond its home state or has a location in another state should understand the meaning of nexus. As a business owner, it is important that you know what nexus is, why it is important, and if you have nexus in other states. I recently presented a webinar on this topic for CPA Academy, and I want to share the information here as well. If you’re an accountant or tax advisor, knowing how to determine nexus in a state will help you when offering guidance to your clients. If you’re a business owner, having a grasp on nexus and its implications for...

How to Choose the Best State to Incorporate a Business

Besides the questions of when and how to start a company, many entrepreneurs want to know where to incorporate a business. Each state has its own business laws and tax codes, so deciding where to form an LLC or a corporation should not be taken lightly. I recently talked about this important topic in a webinar for accounting professionals hosted by CPA Academy. I want to share that information with you, too. It’s valuable food for thought whether you’re advising clients on their entrepreneurial journey or starting your own business. Considerations When Choosing a Business Structure Before...

Incorporating a Business 101

As a business owner, the day will come when you inevitably will have to address the legal aspects of your business – and the sooner the better. And, fortunately, the process can be relatively painless and hassle-free. I talk to countless small business owners and freelancers who consider themselves too small to worry about incorporation. After all, you don't have mazes of cubicles…you may not even have any employees. However, incorporation can still be a smart idea even for the self-employed graphic designer or wedding planner and in this post we discuss the benefits of incorporating your small business.

What Is a Pass-Through Entity?

A pass-through entity refers to a business that does not pay income tax of its own. Its income, losses, credits, and deductions “pass-through” to each business owner’s personal tax return, where its profits are taxed according to each owner’s individual income tax rate. Sole proprietorships, general partnerships, limited partnerships, limited liability partnerships, limited liability companies, and S Corporations are all pass-through entities. Corporations, and limited liability companies that elect to be taxed as a corporation, are not pass-through entities. Many entrepreneurs choose...

What Business Owners Need to Know About Filing Taxes in 2024

2024 has arrived, which means businesses across the United States need to start thinking about filing taxes for 2023. It’s time to determine deadlines and research any legislative and tax code changes that may affect you and your company. For guidance in preparing your 2023 tax return, I encourage you to talk with a professional tax expert. In the meantime, here’s a quick overview of what business owners should consider when filing their taxes in 2024. Sole Proprietorship Taxes Sole Proprietorships are unincorporated businesses with no distinction between the business owner and the...

Does Your Business Need a DBA?

In the course of running your business, you’ve probably encountered more legal fine print and formalities than you ever thought possible. In this post, we’ll break down the Doing Business As (DBA) to see if your business needs one.

How to Avoid Double Taxation as an LLC or S Corporation

There are a whole host of reasons to incorporate as a C Corporation. For example, the C Corporation is the preferred structure if you intend on seeking VC funding or taking the company public. However, forming a C Corporation involves more paperwork, legal fine print, and potential double taxation. In today's article, we'll review how you can utilize an S Corporation or LLC to avoid double taxation. S Corporation Considerations The biggest differences between forming a Limited Liability Company (LLC) and incorporating as an S Corporation arise when you start to look at the more complex...

How the Corporate Transparency Act Affects Your Company

Per the recently passed Corporate Transparency Act (CTA), owners of smaller Limited Liability Companies (LLCs) and corporations will soon have another compliance requirement to adhere to this year. LLCs and corporations with fewer than 20 employees must report information about their owners and company applicants to the federal government. What is the Corporate Transparency Act? The Corporate Transparency Act (CTA) is federal legislation created by the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) and passed by Congress as part of the Anti-Money...

How Many Members Can an LLC Have?

Besides personal liability protection, flexibility is among the top reasons entrepreneurs choose the Limited Liability Company (LLC) business structure for their companies. An LLC can have an unlimited number of owners, called “members” (with few restrictions on who can be a member); an LLC can override its default tax treatment and opt for an S Corporation or C Corporation tax election (if it meets the IRS’s qualification criteria); and an LLC can be managed by the LLC’s members or one or more designated managers. These qualities make operating as a Limited Liability Company attractive...

Can You File Your Own LLC?

Many entrepreneurs who want to form a Limited Liability Company (LLC) think they must hire a lawyer to handle the paperwork. They’re mistaken! While it’s helpful to consult an attorney about which business entity type is right for your business and get answers to other legal questions, you’re not required to have an attorney file your LLC’s Articles of Organization with the state. In fact, you may complete and submit your LLC registration paperwork on your own — or work with an online business filing company like CorpNet. Before I get into the filing requirements for LLCs, let’s revisit...

Professional Corporation vs. Professional LLC

A professional corporation and a professional LLC are business entities that licensed professionals may wish, or be required, to form. Generally, professions that form professional LLCs or professional corporations include: Attorneys and law firms Accountants and CPAs Physicians Engineers Architects Psychologists Chiropractors Dentists Veterinarians Social workers Real estate agents In this article, I'll explain some of the characteristics of the professional LLC (PLLC) and professional corporation (PC) business structures, show how they are similar, and show how they differ from each...

Which LLC Is Right for Me?

Just as there are flavors of ice cream, different varieties of the LLC business structure exist, too. The ideal option for a company may depend on a business's industry, type of commercial activities, number of owners, and even an owners' professional credentials. On the CorpNet website, we offer a tool to help entrepreneurs zero in on the right business entity for them. In this article, I'll describe some general scenarios and the limited liability company structure versions that might be most appealing in those situations. Keep in mind that choosing a business entity type requires...

The Top Reasons Startup Businesses Fail

No one starts a business to see it fail. Seeds of ideas slowly germinate into full-blown business plans bursting forth with sparkle and optimism. This business is your dream and you’ve given it your heart and soul. You know it won’t fail. I’m sorry to say that many startups do fail, and they fail for various reasons. Financial Issues Cash is the lifeblood of a new business. Without it, you can’t afford to pay your employees, purchase inventory and materials, or adequately market your business. You can’t even cover your overhead expenses like rent and utilities. The reasons for cash...

What is a Business Statement of Purpose for an LLC or Corporation?

When starting a Limited Liability Company or C Corporation, businesses in most states must provide a written statement of business purpose in their formation documents (Articles of Incorporation or Articles of Organization). The business purpose statement describes why, and for what legal purpose, will the business exist. This is not the same as a company's mission or vision statement, which businesses often leverage when seeking financing, attracting customers, and rallying employee morale. In most states’ Articles of Incorporation and Articles of Organization, the purpose statement is a...

How to Calculate Profit Margins

Passion, energy, and enthusiasm are essential entrepreneurial traits for launching a business — and so is an understanding of financial performance. To sustain and grow an LLC or Corporation, a business owner must keep an eye on its profitability. Calculating profit margin reigns as one of the most telling ways to assess a company's financial standing. What Is Profit Margin? Profit margin measures your company’s profitability after deducting expenses from its revenue. It’s expressed as a percentage — indicating the ratio of profit to revenue. For example, if your business has a 30% profit...

How to Start a Small Business in Texas in 10 Steps

If you've been exploring how to start a small business in Texas, this article is for you. Learn 10 steps to launch a business in the Lone Star state.

Three Tips for Business Coaches to Help Their Clients Succeed in 2019

How can you help your coaching clients achieve entrepreneurial success? These tips for business coaches will help you help your clients succeed.

The Best CPA Marketing Channels for Growing Your Firm

Whether your accounting business is just starting out, or whether you’re a seasoned veteran, marketing your business is a must. It’s crucial in good economic times and in bad. In fact, during an economic downturn, choosing the right CPA marketing channels for your business matters more than ever. Smart marketing can give you the edge you need to succeed—if you know where to spend your time and money! Listed below are five CPA marketing channels sure to help grow your accounting business. 1. Direct Mail Along with huge accounting staff, huge accounting firms have huge budgets. How can you...