The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

Year End Small Business Tax Tips to Reduce Tax Payments in 2025

Before you let the hustle and bustle of the holiday season take over your business (and your life), now’s a good time to review your financial situation and explore some money-saving small business tax tips. Below is a list of my top tax tips entrepreneurs can still benefit from at year-end. 1. Deduct Startup Expenses Did you start your business this year? You may be able to claim some of your startup expenses on your tax return in the year you actually opened the business. To qualify as a startup expense (a capital cost), the IRS requires the expense to meet two requirements: The expense...

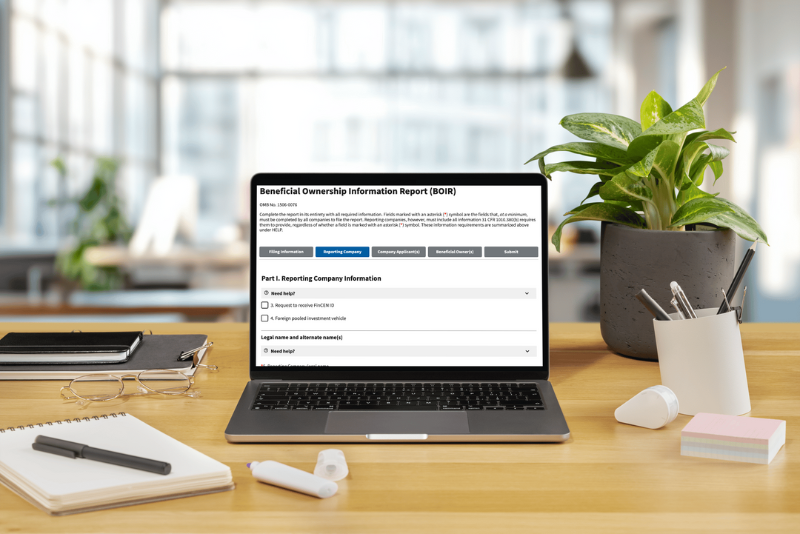

Federal Court of Appeals Reinstates Enforcement of BOI Reporting Requirement

Throughout the year, we have provided several updates about the 2024 Beneficial Ownership Information Reporting mandate. Recently, there’s another development you should be aware of. The temporary suspension of the BOI reporting rule has been lifted, and reporting companies are once again required to file BOI reports. On December 23, 2024, the federal Court of Appeals decided to end the preliminary injunction (effective December 3) that suspended the U.S. Treasury Department and FinCEN from enforcing the Corporate Transparency Act (CTA) and its BOI reporting requirements. This means...

Should You Incorporate at Year End or Wait Until 2025?

If you’re gearing up to incorporate and get your business off the ground at the start of 2025, you might wonder when to file your business formation paperwork. Can you submit your incorporation forms now and request an effective date that is delayed? After all, the end of December tends to be ultra-busy. Trying to complete all the forms and manage all the details amid that chaos will only compound the stress. Choosing the right business entity type for your business is a critical decision, and so is determining when to file your forms with the state. In this article, I’ll give you...

When to Incorporate a Startup

If you’ve been operating your business as a Sole Proprietorship, you may be wondering when’s the right time to incorporate your startup as a bona fide business entity. There are various reasons to consider incorporation and its important to know your timing can matter! Five Signs It's Time to Incorporate Naturally, every company’s situation is different, so various factors play a role in determining the ideal time to register a business entity. Circumstances when forming an LLC or Corporation may be advantageous for a startup include the following items. 1. Conducting Business Activities...

What Business Owners Need to Know About Filing Taxes in 2025

The new year is right around the corner, which means businesses across the United States need to start thinking about filing taxes for 2024 It’s time to determine deadlines and research any legislative and tax code changes that may affect you and your company. For guidance in preparing your 2024 tax return, I encourage you to talk with a professional tax expert. In the meantime, here’s a quick overview of what business owners should consider when filing their taxes in 2025 Sole Proprietorship Taxes Sole Proprietorships are unincorporated businesses with no distinction between the business...

What Is a Commercial Registered Agent?

Choosing a commercial registered agent provides advantages that can significantly benefit your business and help make sure your company remains in compliance with all laws and regulations. If you have a Corporation, Limited Liability Company (LLC), Limited Partnership, Limited Liability Partnership (LLP), or other business that’s registered with the state, you’re required to have a registered agent in that state. If your company conducts business in states other than the one in which it was originally registered, you’ll need to have a registered agent in each of those states, as well. The...

Court Rules to Temporarily Suspend Enforcement of BOI Reporting Requirement

Throughout the year, we have provided several updates about the 2024 Beneficial Ownership Information Reporting mandate. Recently, there’s another development you should be aware of. If you haven’t already submitted your BOI report to FinCEN, you’ll want to carefully consider the announcement and its potential impact. On December 3, 2024, the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction, suspending the U.S. Treasury Department and FinCEN from enforcing the Corporate Transparency Act (CTA) and its BOI reporting requirements. This court...

What Is a Franchise Tax?

A franchise tax is a fee that some states charge businesses for the right to conduct business within the state. Less than half of all U.S. states levy a franchise tax on businesses like C Corporations and Limited Liability Companies. States that do impose this "privilege tax" have different rates and rules pertaining to it. Some states exempt certain types of businesses, such as nonprofits from having to pay the tax. And some companies operating within a certain industry that’s considered beneficial, such as renewable energy, may also be exempt. Also, businesses that are not registered...

How to Keep Your LLC Compliant

Running a business and staying up to date with LLC compliance can be a bit overwhelming for many entrepreneurs. There are a lot legal requirements at the federal, state, and local level to track and take action on throughout the year. And to make matters worse, the requirements can vary depending on where the company is located, the industry, its business activities, whether it has employees, and other factors. As we venture into the last few weeks of the year, I'd like to provide a recap of the primary LLC compliance items you need to be aware of, and most likely, take action on before...

How to Record the Buyout of a Partner

Sometimes business partnerships just don’t work out. Whether it’s due to disagreements or because one partner wants to pursue other opportunities, it’s essential to know what your options are when it’s time to split up a partnership. One common scenario is when one partner wants out, but the other partner (or partners) wants to continue the business. In that case, a partner buyout is a likely solution. Knowing the proper way to buy out a business partner will save you time, money, and a lot of hassle in the future. Here’s what you should know about a partner buyout. The Importance of a...

Expanding a Small Business to Another State: What You Need to Know

Extending your small business’s presence across state lines can help your company reach new markets, grow revenue, and boost profits. But how do you expand a small business into another state? And what’s involved in operating a business in multiple states? There are some filing requirements to operate in other states legally and tax-related considerations that need attention. Of course, none of that should be taken lightly, so entrepreneurs should research the requirements of the state(s) where they want to conduct business. It’s also beneficial to consult an attorney and tax advisor or...

What You Need to Know About Collecting Sales Tax

Before a retailer or service provider can open for business, they first must get approval from the state for sales tax registration. Not all states charge sales tax, and not all products and services are taxable, so it’s essential to learn the facts before you find yourself in compliance hot water. Here’s what to know about your business’s responsibilities regarding the collection of sales taxes. Sales Tax Vary by State and Sometimes by County Currently, forty-five states and the District of Columbia collect statewide sales taxes, while five states do not have a statewide sales tax. The...

LLC Dissolution vs. Termination

Businesses open and close all the time. The U.S. Small Business Administration reports that between March 2021 and March 2022 about 1.2 million small businesses opened and approximately 834,000 closed. If you’re faced with closing your Limited Liability Company (LLC), there are steps you’ll need to take to make sure it’s done legally. Failing to do so can cost you money and result in negative consequences down the road. While the words dissolution and termination are often used interchangeably when referring to closing an a business, they have different legal meanings and refer to two...

How to Change Your Business Entity

It’s not unusual for an entrepreneur to change their business from one entity type to another. Most often, someone who’s been running a Sole Proprietorship or General Partnership sees a need to register their business with the state and become either a Limited Liability Company (LLC) or a Corporation. This could occur because owners wish to lower their risk for personal liability if the business is sued or can’t pay its debts. Tax considerations are another reason for changing a business structure, as is an increased ability to attract investors and raise capital for the business. Or...

Incorporate Before Year End to Avoid Issues at the Secretary of State

Think you’re the only business owner who wants to incorporate or form an LLC before the end of the year with your Secretary of State? Think again. Registering a business at the end of a calendar year can take longer than any other time of the year. Because everyone waits until the end of the year to change their business structure for the New Year, there's a lot of competition. What might normally take just a few weeks to get approved can take a lot longer. Waiting until December to register your business with the Secretary of State could mean your application gets backed up into February...

What Is a Domestic LLC?

If you registered your Limited Liability Company in the state where you live and you are conducting most of your business in this state, your company is known as a Domestic LLC. It is licensed by the state to do business there and expected to uphold all the laws and regulations imposed by the state. While the definition of a Domestic LLC is straightforward, it’s important to understand there are variations on this type of business structure, such as a single-member or multi-member LLC or a member-managed or manager-managed LLC. And, depending on its purpose and how it’s registered, a...

Do I Need a Certificate of Good Standing for My LLC?

If you want to open a business bank account for your Limited Liability Company (LLC), apply for a loan or a line of credit, or conduct certain other types of business, you’ll probably need a Certificate of Good Standing, also known in some states as a Certificate of Status, Certificate of Authorization, Certificate of Existence, or Certificate of Subsistence. A Certificate of Good Standing is a document issued by the state to companies in compliance with all applicable rules and regulations. The document typically includes the name or entity number of the business to which it’s issued,...

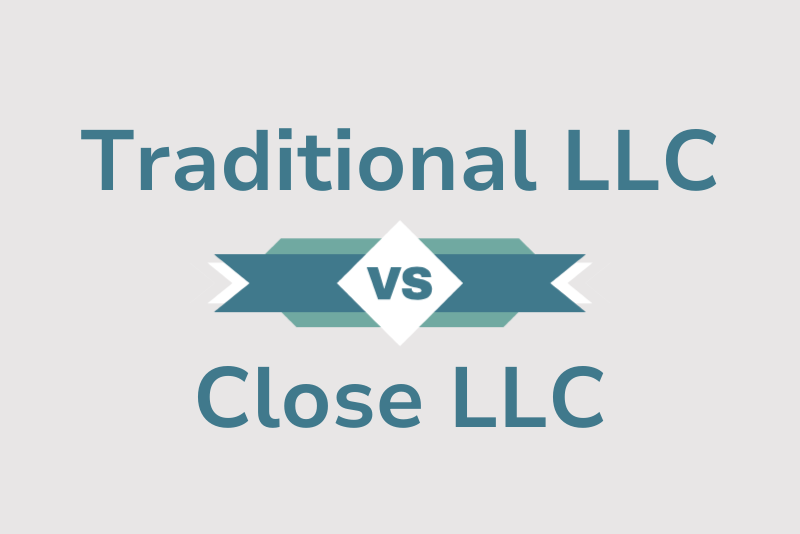

Traditional LLC vs. Close LLC

A Close LLC and a traditional LLC are essentially the same regarding how they’re formed, the personal liability protection they provide to business owners, and the tax flexibility they provide. A traditional LLC and a Close LLC have the following similarities: Both Close LLCs and LLCs are created by filing a formation document called articles of organization (or certificate of organization) with the state. Both Close LLCs and LLCs limit the LLC members’ personal legal responsibility for the liabilities of their business. Both Close LLCs and LLCs may choose one of the following tax...

Who Is Authorized to File a BOI Report?

If a company is required under the Corporate Transparency Act to submit a BOI report to FinCEN, an authorized individual must file the report. But who is authorized to file the BOI report? The business’s owner may file the BOI report or authorize an employee or even a third-party service provider to prepare and submit the filing on their reporting company’s behalf. The filer must provide basic information about themself, including their name and email address. Examples of the types of third parties who are authorize to file BOI reports include: Attorney Accountant Enrolled agent Business...

Can I Change My Sole Proprietorship to an LLC?

If you’re wondering if you’re able to change your Sole Proprietorship to a Limited Liability Company, the answer is a resounding yes. And I’ll go a step further and tell you that not only can you change your Sole Proprietorship to an LLC, but that you probably should change it. Changing your Sole Proprietorship to an LLC, which means the business would be recognized by the state and operate under a legal structure, isn’t a particularly difficult task, but it needs to be done carefully and in accordance with the rules of your state. Not taking the proper steps and fulfilling state...

Does a Foreign Corporation Need an EIN?

Obtaining an Employer Identification Number (EIN) is one of multiple steps involved in getting a foreign-owned Corporation set up to conduct business in the United States. An EIN is a nine-digit federal tax ID number issued by the Internal Revenue Service (IRS). All non-exempt business entities (domestic and foreign operating) that operate in the United States are subject to federal income tax, and the EIN is what the IRS uses to track a company’s IRS filings, tax liabilities, and payments. Therefore it is safe to say that most foreign Corporations will require an EIN to maintain...

Who Is a Beneficial Owner of a Business?

Any business entity that meets the Corporate Transparency Act (CTA) definition of a reporting company must report its beneficial owners in a Beneficial Ownership Information (BOI) report filed with the Financial Crimes Enforcement Network (FinCEN). While some exemptions and exceptions exist, the majority of small and mid-sized businesses formed as LLC, Corporations, and other registered entities are subject to the reporting rule. The Definition of a Beneficial Owner The CTA identifies a beneficial owner as an individual who either directly or indirectly exercises substantial control over...

Can You Use a UPS Store or PO Box for a Registered Agent?

It may seem very appealing to use a UPS store or PO Box for your registered agent, but this comes with a lot of risks. And in some states, this action can result in the closure of your business. Let's walk through what a registered agent is and why opting to use a USP Store or PO Box for your registered agent is not the best course of action. Who Needs a Registered Agent? A registered agent is a person or company with the authority to accept service of process (legal documents and government notices) on behalf of a company. You will most likely need a registered agent if you own one of...

How to Properly Handle Your Company’s Annual Meeting Minutes

Businesses that have incorporated as a corporation or formed a limited liability company (LLC) must carefully document their compliance activities. For example, when a corporation holds its annual general meeting (a.k.a, annual shareholder meeting), it must keep a record on file for regulatory compliance purposes. Most states require that C Corporations (including those that have elected for S Corporation tax treatment) hold a general meeting for their shareholders every year. Usually, they are also required to hold at least one meeting with their board of directors yearly. Businesses...

12 Steps for Closing a Corporation by Year End

As difficult as it may be to make the decision to close a business, things can become even more challenging if a business’s owners don’t tie up all the loose ends. If you’re thinking of closing your corporation by year-end, realize that there’s more to the process than halting the sale of products and services. Merely stopping business activities doesn’t officially close a company, there are steps that must be taken to legally end the business entity’s existence. The exact actions a corporation’s owners must take will depend on where the business is located, whether it has employees, or...

Why Your Inactive Business is Probably Costing You Money

Someone once told me that a true sign of a successful entrepreneur is the ability to know when it’s time to throw in the towel and move on. One failed business doesn’t define an entrepreneur. Plus, when one door closes, another usually opens. Closing a business doesn’t just mean selling your assets and calling it a day. You’ve got to go through the requisite steps to ensure your business is legally closed and that you’ve properly wound up your business affairs. Otherwise, you could be personally responsible for filing annual reports, filing state and federal tax returns, and maintaining...

Do Inactive Business Entities Need to File a BOI Report?

Some business owners have expressed confusion over whether they must file a beneficial ownership information (BOI) report if their business entity ceased to exist before the BOI reporting requirements took effect on January 1, 2024. Fortunately, the Financial Crimes Enforcement Network (FinCEN) has finally provided some clarity on the topic! Here is a summary what you need to know about reporting for inactive businesses: If a business entity ceased to conduct business and formally dissolved before January 1, 2024, it was never subject to the BOI reporting requirement. Therefore, it does...

How to File an Annual Report for an LLC

An LLC annual report is a form that most states require domestic and foreign Limited Liability Companies to submit each year or biennially. A critical compliance task for keeping a business entity in good standing, filing an annual report updates the state on an LLC’s essential information, such as its principal business address, the names of its members or managers, and its registered agent details. Knowing when and how to file an annual report for your LLC is an important part of keeping your business in compliance. Let's review the steps, so you stay in good standing. Keep in mind, the...

Do I Need to Renew My LLC Every Year?

Registered Limited Liability Companies (LLCs) are required to renew their registration, which is an important step in remaining compliant with applicable laws and regulations. Nearly every state calls for some type of renewal filing for LLCs and renewal requirements vary significantly from state to state. Colorado, for example, mandates that an LLC renews annually at the end of the month in which it was formed. Indiana also requires renewal at the end of an anniversary month, but only every other year. LLCs in Maine must file annually by June 1, while the due date in Maryland is April 15...

Benefits of Forming an LLC

The Limited Liability Company (LLC) business structure is a popular choice for entrepreneurs who want to protect their personal assets, enjoy tax and management flexibility, and keep corporate formalities to a minimum. In this article, I’ll discuss the main benefits of creating an LLC to help you understand why so many business owners choose this entity type for their companies. 7 Top Advantages of Registering an LLC 1. Simplicity The business registration paperwork to form an LLC is minimal, as are the ongoing filing requirements. It’s second only to the Sole Proprietorship and General...