The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

C Corporation Tax Rates

There are many reasons companies choose to incorporate as C Corporations. Being a C Corporation is preferred if you plan to seek investors or take the company public. Also, because the C Corporation is a legal, taxable entity separate from its owners, shareholders’ personal liability is limited to the amount they have invested in the company. In contrast, owners of Sole Proprietorships and Partnerships are personally liable for the business’s debts and legal issues. Although becoming a C Corporation involves more paperwork and continuous compliance, many business owners find the C...

Can a Nonprofit Have a DBA?

Sometimes business owners want to market their services or products under a name other than their legal business name. For instance, a Sole Proprietorship, who must have both the owner’s first and last name in the business name, will want to use a fictitious name that’s more creative and compelling. They have to get permission to use that fictitious name by filing a DBA (doing business as). But other business entities, such as Nonprofit Corporations, may also have reasons for using a DBA. If you're wondering if a Nonprofit Corporation can register a DBA, the answer is yes and I’ll cover...

The Ultimate Checklist for Starting a Business in New York

New York is a great place to start a business and begin your journey of entrepreneurship. This article will walk you through the many things business owners should know and address to get their new businesses up and running.

The Difference Between a Business Entity Statutory Conversion and Business Domestication

Statutory conversion vs. business domestication. One changes a business entity type; the other changes a company's home state. Read on to learn more!

CorpNet Awarded Inc. Pacific Regionals for 2023

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. Regionals Pacific list in 2023 as one of the fastest-growing private companies in the country. This is the second year CorpNet has been honored in the regional awards. With a healthy 244% 2-year growth, CorpNet made a significant move from position 213 to 75. CorpNet's Inc. profile can be found here. “I am beyond proud of the exponential growth our company, CorpNet, has achieved in the last year which has helped us secure a spot on the coveted Inc.5000 Pacific Regionals list in 2023. We did not let the uncertainty in...

Do I Need an LLC to Freelance?

Do freelancers need an LLC? That’s a question many solo professionals ask as they start and grow their small businesses. While freelancers aren’t legally obligated to form a Limited Liability Company, doing so offers some advantages over operating as a Sole Proprietorship. In this article, I’ll touch on the difference between running a freelance business as a Sole Proprietorship vs. an LLC. I’ll also summarize what’s involved in creating a Limited Liability Company and answer some frequently asked questions about operating as a freelance LLC. Sole Proprietorship vs. LLC Most freelancers...

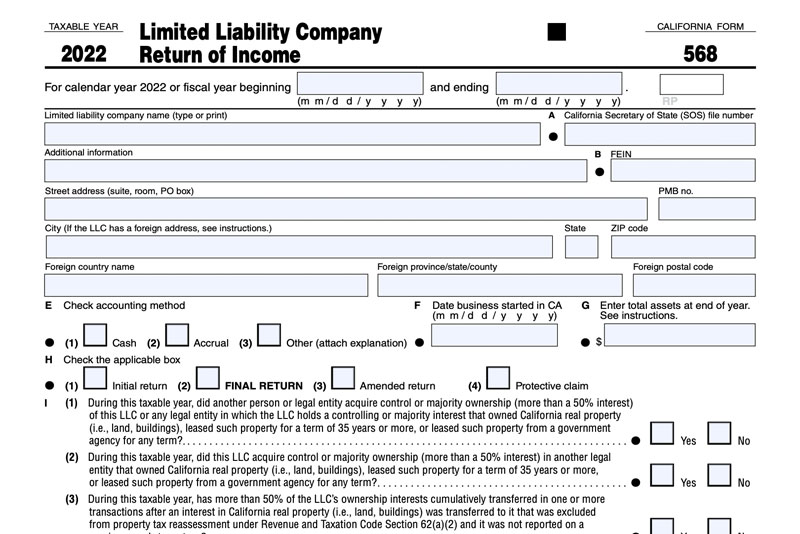

Which California Businesses Must File Form 568?

If you’ve decided to structure your business as a Limited Liability Company (LLC) and plan to register your company in California, it’s crucial to know how to keep your company in good standing by following the state’s compliance regulations. One regulation particularly important to California LLCs concerns their tax filing requirements. What is Form 568? Most LLCs doing business in California must file Form CA Form 568 (Limited Liability Company Return of Income), Form FTB 3522 (LLC Tax Voucher), and pay an annual franchise tax of $800. These businesses are classified as a disregarded...

Can You Change an LLC Name?

The decision to change an LLC name is one not to consider lightly. After all, your business name is one of your most important brand assets. But sometimes, a name change is in order for one of many reasons. Perhaps there was a mistake in your formation paperwork, so you need to correct the name. Or perhaps the name was fine in the past, but now it's not because it includes the name of a business partner who just retired. Or maybe your business has expanded into other products or services, and the name no longer accurately reflects what you do. Another reason you might consider changing...

How to Start a Tutoring Business

Wondering how to start a tutoring business? This step-by-step guide will help you through the planning and launch process.

Does Your Business Need a Sales Tax License?

Does your business need to collect sales tax and remit it to the state or local tax authority? And if it does, how do you go about getting a sales tax license? Moreover, what if your business is selling your products across state lines? Do you need to charge and remit sales tax in those states, too? These are all valid and important questions! We're going to delve into them in this article to give you some helpful food for thought as you research what requirements apply to your business. Please keep in mind that all I share here is for discussion purposes. For professional tax guidance,...

How to Start a Dropshipping Business

It's estimated that a third or more of e-commerce brands use dropshipping as a way to provide products to customers. If you've been thinking about starting an online store but don't want to deal with the costs and hassle of maintaining inventory, you may find the dropshipping business model a viable approach. Ready to learn more about dropshipping as a way to fulfill customer orders? Let’s talk about what it is, some points to consider about the business model, and how to start a dropshipping business. What is Dropshipping? Dropshipping is an order fulfillment approach that enables...

The Consequences of Noncompliance in Business

Business compliance is a phrase that makes many an entrepreneur cringe. But despite the lack of affection for those two words, business owners must take them seriously. The possible consequences for noncompliance range from mild inconvenience to devastating disaster. Most critical is that noncompliance by Limited Liability Companies and Corporations can lead to piercing the corporate veil, which puts business owners’ personal assets at risk. Before I get into the penalties for noncompliance, let’s first take a moment to discuss what it is exactly. What is Noncompliance in Business? Nearly...

How to Start a Business as a Kid or Teen

Starting a business as a kid or teen is exciting! With it, comes an opportunity to learn life-long skills that will help you become a successful adult. And, of course, there's the money you can earn! But how do you start a business as a kid or teen? Well, regardless of your age, you will need to follow pretty much the same business-related rules as when starting a business as an adult. Your parent or guardian will be one of the most important resources in your journey. While you’re their dependant in their household, you’ll want to involve them in the process so that you can get your...

How to Start a Virtual Bookkeeping Business

Wondering how to start a virtual bookkeeping business? This article shares what aspiring self-employed bookkeepers need to think about.

How to Start a Trucking Business

If you’ve always wanted to start a trucking business, now could be the perfect time to put your plan into action. The trucking industry has had an immense impact on the U.S. economy. According to American Trucking Association, 71% of the freight tonnage moved in the United States goes on trucks. So how do you become part of this booming industry? Whether you’ve been a driver for another company and want to begin as an owner-operator, this article will offer insights that can help you work toward achieving your goals. Determine Staffing Needs There are a couple of different ways to begin...

The Bookkeeper’s Guide to Outsourcing

How many of your bookkeeping clients are business owners outsourcing their accounting tasks to you? If you’re lucky, probably quite a few, since small and large businesses alike have plenty of complicated financial needs. Smart business owners know that outsourcing tasks not in their wheelhouse are a great way to free up valuable time that can be better used to grow their businesses. Just as with your clients, wearing all the hats in your bookkeeping business is not the best use of your skills. When does hiring an expert help make more sense for your needs and your bottom line? Here are...

A State-by-State Guide to Economic Nexus

Economic Nexus The Supreme Court ruling on the South Dakota v. Wayfair case in 2018 changed how out-of-state retailers collect and remit sales taxes in each state. At a minimum, states can mandate that businesses without a physical presence in a state and with more than 200 transactions or $100,000 in-state sales can be required to collect and remit sales taxes to the state where the goods are purchased. Because sales tax regulations vary by state, each state has its own rules, registration process, and tax rate for out-of-state retailers that reach economic nexus in that state. In most...

Can You Have Multiple EIN Numbers?

Just as a Social Security Number identifies an individual taxpayer, an Employer Identification Number (also known as an EIN, Federal Tax ID Number, or FTIN) is a nine-digit number that identifies a business entity. In addition to the IRS and other tax authorities using EINs to track payments, reports, and other filings, other government agencies, financial institutions, and even vendors may ask for a company’s EIN when opening accounts, approving loans, or engaging in transactions with the business. While a business entity can have only one EIN, a business owner can request more than one...

What Happens If You Accidentally Miss a Tax Deadline?

In this article, I’ll discuss the potential consequences for professional tax services providers and their clients (taxpayers) when tasks get forgotten and tax deadlines have been missed. I’ll also touch on options for resolving late filing and payment issues with government agencies.

A State-by-State Guide to Seller’s Permits

If your business plans to sell products or services, most states will require you to obtain a seller’s permit. This seller's permit can also be called a sales tax license or sales and use tax permit. The process and fees for obtaining a seller’s permit vary by state, as do the rules for remote sellers. States that require a seller’s permit or sales tax license will require businesses to collect sales tax on products and services sold to customers living in their states. This tax will then be reported and remitted to the state on a predefined schedule. Failure to collect and remit sales...

What Is a Fictitious Name?

What Is a fictitious name? A fictitious name is a name other than your proper legal business entity name that you formally get permission from the state (or county) to use when conducting business. You may also see a fictitious business name referred to as: Doing Business As (DBA) Assumed name Trade name Throughout this post, I will use the terms “fictitious name” and “DBA” interchangeably. At CorpNet, we help business owners throughout the United States file DBAs. Fictitious names can benefit businesses of all types—from sole proprietorships to LLCs to corporations. At CorpNet, we help...

What Is a Letter of Good Standing?

Professionals like you, who help entrepreneurs navigate the challenges of starting and growing their businesses, will likely encounter clients asking about a "Letter of Good Standing." Let's take a moment to talk about what a Letter of Good Standing is and why maintaining a status of good standing is so important. A Letter of Good Standing refers to a certificate issued by a state's Secretary of State office (or comparable agency). It verifies that a registered business (e.g., an LLC or corporation) has complied with all of the state's rules for conducting business in that state. "Good...

How to Start an Accounting Business

Whether you’re a finance major fresh out of college or have been working in an accounting firm or department for years, I’ll bet you’ve thought about being your own boss. There’s a lot to consider when exploring how to start an accounting business. Let's dig into the necessary steps and mistakes to avoid. Starting an accounting business offers an opportunity to chart your own professional course and enjoy the flexibility and control of self-employment. Of course, there's plenty of research and work involved in the process. You'll want to be thorough and well-informed as you make decisions...

Can an S Corporation Use LLC or Inc in Its Business Name?

If you are considering electing S Corporation status you might wonder how this will impact your existing LLC or C Corporation. One question that comes to mind quickly is the continued ability to use LLC or Inc with a business name. S Corporation election is a tax classification, it does not change a business’s legal structure. Limited Liability Companies and C Corporations that elect S Corp status remain the same underlying business entity and retain their legal business name. Therefore, a Limited Liability Company may use "LLC" (or another limited liability company designator allowed by...

How to Legally Change a Business’s Name

Despite your best efforts to choose the perfect name for your company, there may come a time when that name no longer is the best fit. Perhaps the business name no longer accurately reflects your brand or there are legal considerations at play. Regardless of the reasons to make a business name change, it’s a process that many entrepreneurs find confusing. The steps involved can vary depending on the business entity type and state of registration. You may not expect ever to have to change your company name but knowing what to expect will help alleviate some of the stress if ever you do...

Should I Incorporate or Form an LLC for My MLM Business?

Also sometimes called network marketing companies, a multilevel marketing company (MLM), offers income opportunities to folks who want to set their own schedule and work at their own pace—without having to build a business from the ground up. Many people who want the flexibility of being their own boss have chosen careers working as agents for MLM companies, so I regularly field questions from these entrepreneurs about what legal structure will be optimal. MLM entrepreneurs are considered independent contractors. Sometimes they are also referred to as independent consultants, independent...

Do Amazon Sellers Need an LLC?

Amazon sellers, like other entrepreneurs that sell products online, should think about how their business structure affects them professionally and personally. The business entity type chosen has an impact on income tax obligations, ongoing business compliance requirements, and the financial and legal liability of the business owner. So, you’re asking a valid question if you’re wondering if Amazon sellers need an LLC or is a Sole Proprietorship or no entity at all is sufficient. While it doesn’t appear that Amazon requires sellers to form their businesses as any particular business entity...

How to Apply for an EIN

One of the essential steps new business owners must take when launching their companies is to apply for an EIN. An Employee Identification Number (also known as a Federal Tax ID Number or Tax ID Number) is a nine-digit number assigned to a business for filing taxes, submitting reports to the state, applying for business licenses and permits, and completing other documentation. Similar to how a social security number serves as identification for an individual, an EIN serves to identify a business. The IRS issues EINs at no charge. Is an EIN Necessary? The IRS identifies the specific...

Can an S Corporation Own an LLC?

When entrepreneurs want to expand their businesses, they face the important decision of how to structure that growth. One approach is to form a separate company under another registered business entity. Some restrictions exist and small business owners may be wondering if an S Corporation can own an LLC (Limited Liability Company). The answer is yes and in today's article, I’ll shed some light on what S Corporation ownership of an LLC means and how an S Corporation may benefit from being a member of an LLC. What is an LLC? A Limited Liability Company is a business entity that provides...

What Is 501(c)(3) Status and How Do You Obtain It?

Have you always dreamed of starting a nonprofit organization so you can give back to your community? Maybe you have a charity that’s close to your heart, such as research for autism or helping the homeless, and you’ve always wanted to have the same kind of impact through your own nonprofit. Whatever your vision, making your nonprofit organization a success starts the same way as any other business—by staying in compliance with government regulations. Your nonprofit organization is accountable to state and federal agencies, including the IRS, which is where 501(c)(3) (also referred to as a...